This week, we look at:

- Tesla’s car deliveries beating expectations, increasing hope that it will be included in the S&P 500

- The making of a new Chinese stock bubble

- Uber finally buying a competitor

Tesla’s Q2 car deliveries and its fight to be included in the S&P 500

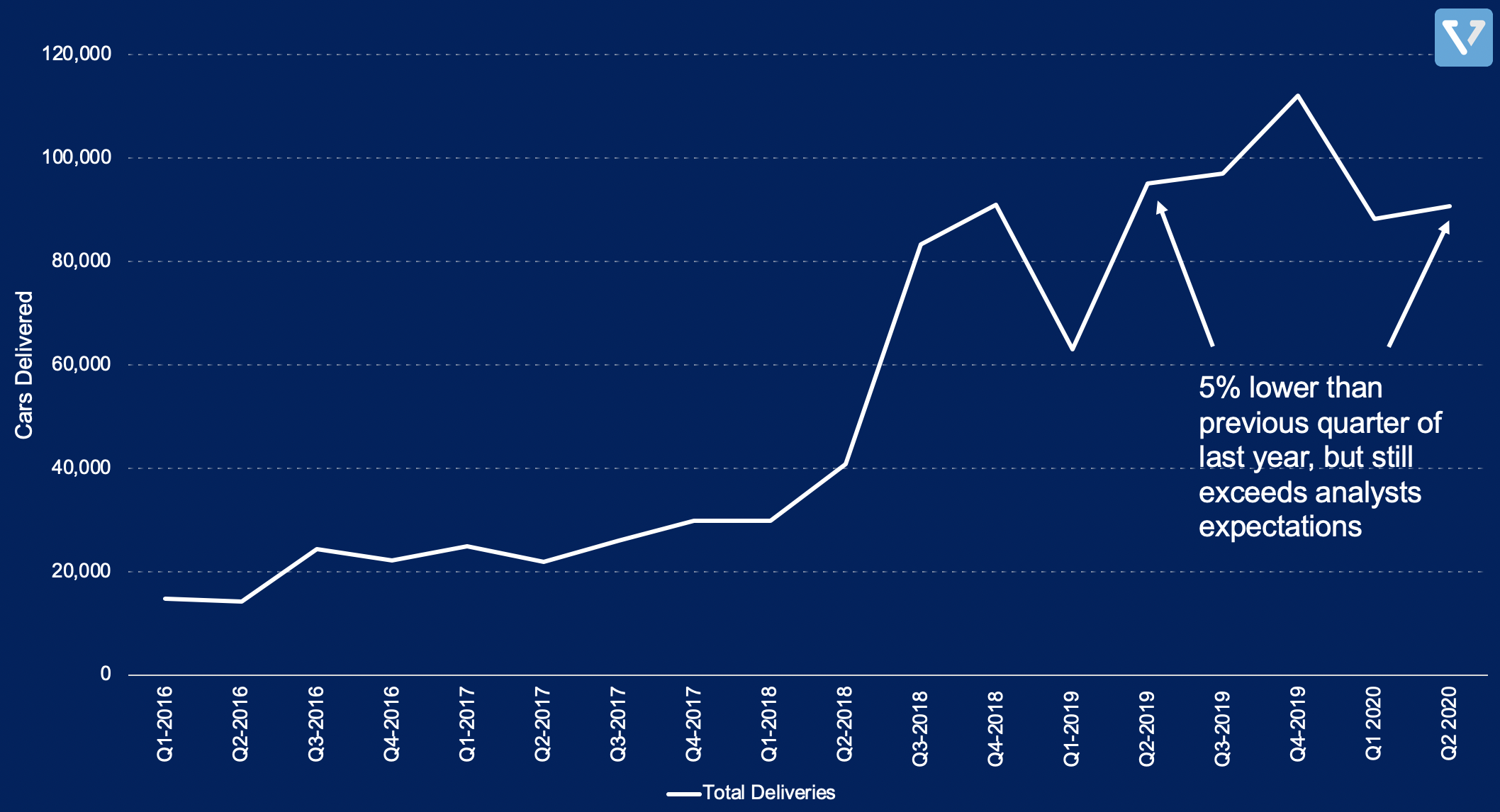

Tesla’s share price surged after the company announced near record car deliveries for Q2 2020 (note that the number of delivered cars is an important metric for Tesla, as it is a leading indicator for revenue). The company delivered more than 90,600 cars. Even though this figure is 5% lower than the same quarter last year, it far exceeds analysts’ estimate of between 60,000 – 70,000 vehicles in the second quarter of 2020. Wall Street was expecting a much larger decline due to the global lockdown.

Figure 2: Tesla car quarterly car deliveries

Tesla’s stock is currently trading at 158 times expected earnings (pricey considering that is about 7.5X higher than the average forward P/E of 21 for the S&P 500). This rally is likely driven not only because of the improved outlook of the company, but also because of the increased likelihood that Tesla will be added to the prestigious S&P 500 index.

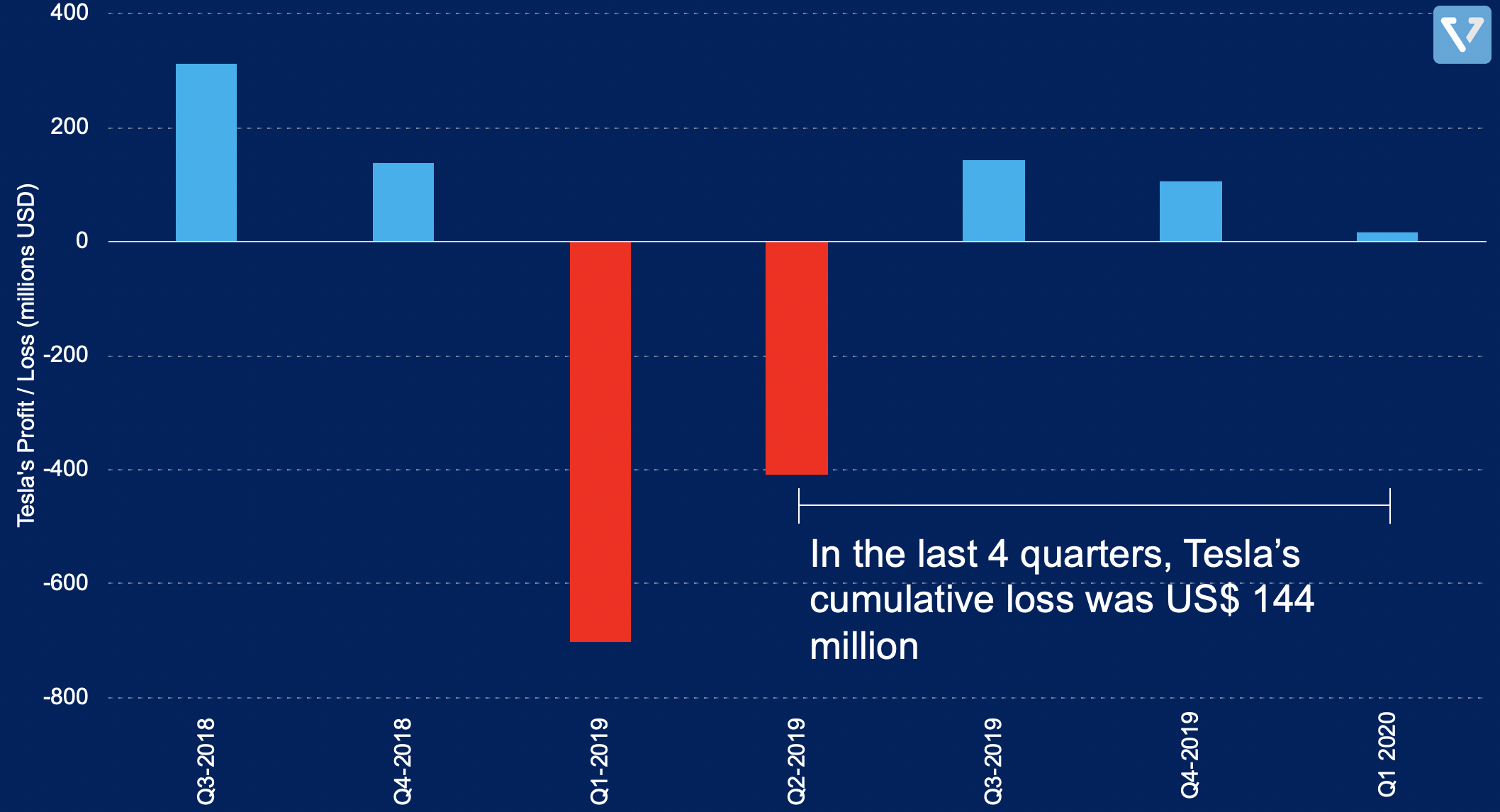

To be included in the S&P 500, Tesla must achieve two things: (1) post positive profitability in any 4 sequential quarters, and (2) its most recent quarter must be profitable.

Figure 2: Tesla’s quarterly profit / loss

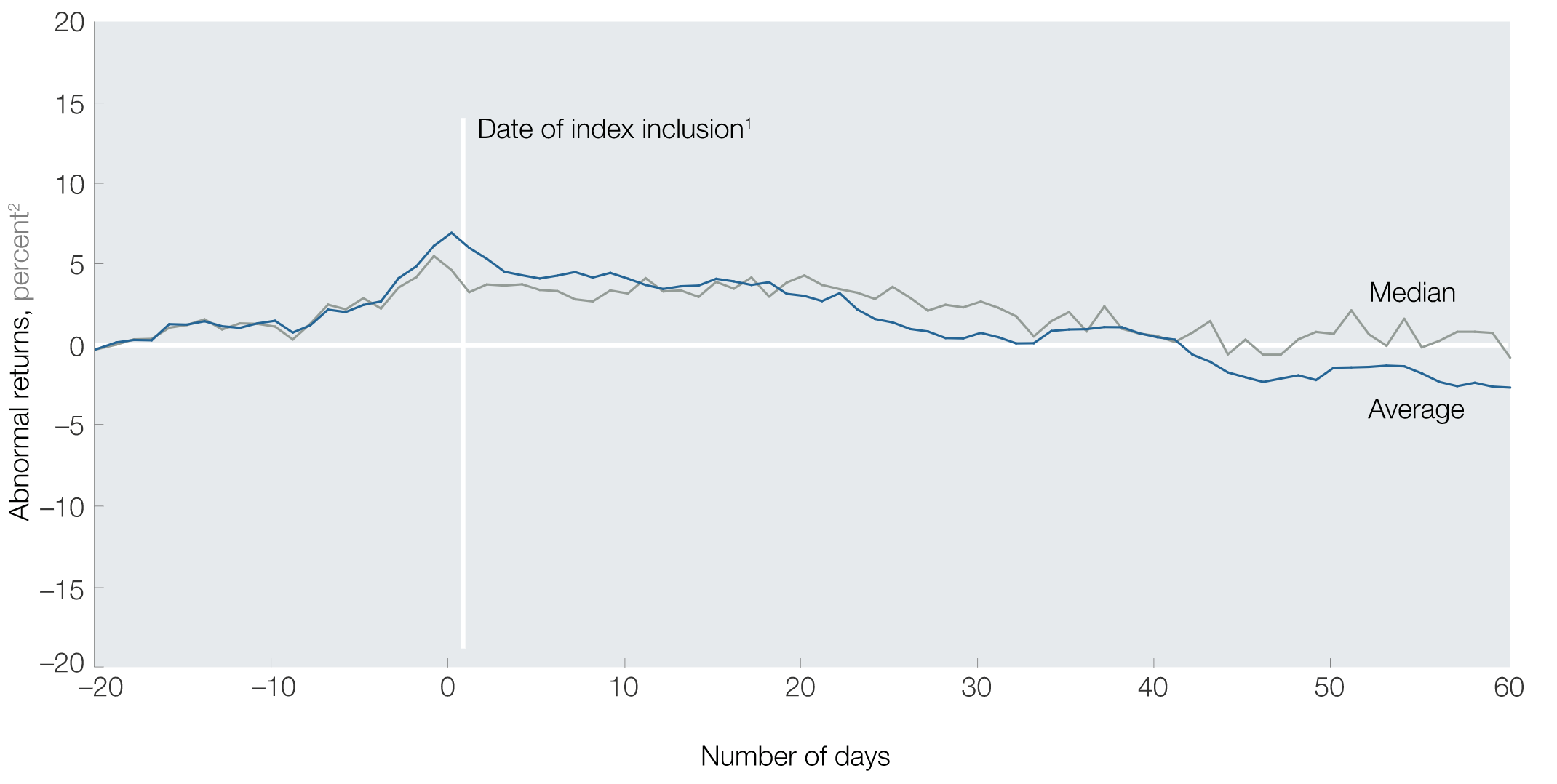

As you can see in Figure 2, after three sequential profitable quarters,Tesla is on the cusp of achieving both milestones. This means that if Tesla posts even a US $1 profit, there’s a good chance that the S&P 500 will add the company to the S&P 500 index. If this happens, the company’s stock prices may rally even further as institutions and index funds purchase the stock (it is possible that the rally has already begun). Regardless, it is to be noted that the index inclusion rally typically starts 20 days before a company’s formal addition and is typically short lived (Figure 3).

Tesla is expected to announce its Q2 2020 earnings on July 22, 2020.

Figure 3: Abnormal returns around index inclusion occurs weeks before a company’s date of addition and is typically short lived (source: Mckinsey Analysis)

Chinese stock market surged after the government said it is OK to be bullish

The Chinese stock market surged on Monday after multiple articles posted on state-owned-media suggested that investors should pile into the market:

- On Friday, the state-owned Shanghai Securities News ran a story titled “Hahahahaha! The signs of a bull market are more and more clear†(you can’t make this stuff up….).

- On Monday, the front page editorial of the China Securities Journal (a state-owned financial newspaper) printed that creating a “healthy bull market†is important.

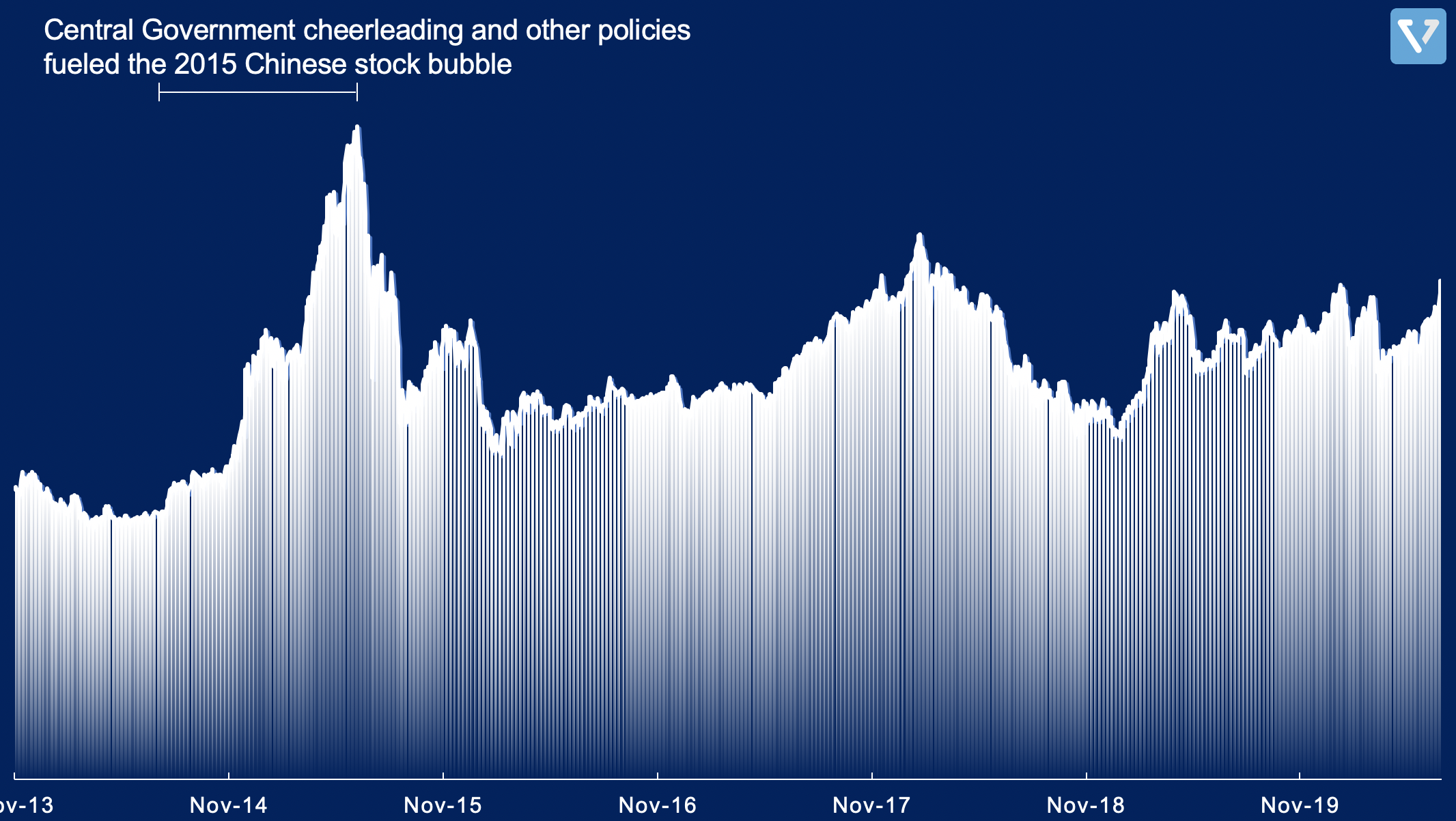

As a result, the CSI 300 index of Shanghai surged 5.7% with heavy volume. This move by the government is reminiscent of 2014 – 2015, when the central government tried to stimulate the stock market in hopes of accelerating economic recovery.

The rally may end up in tears, however, as the increase in stock prices is not accompanied by recovering fundamentals. From June 2014 – 2015, the Chinese central government enacted policies and cheerleading practices that fueled a 150% rally in the Chinese stock market… until it all came tumbling down (Figure 4).

Figure 4: Performance of the Chinese Shanghai Index (CSI-300) from November 2013 to now

Uber bought Postmates, a competitor in the delivery space

After its attempt to acquire Grubhub was rebuffed, Uber announced that it would buy Postmates for US $2.65 billion in an all stock deal. Postmates was last privately valued at US $2.4 billion in Q4 2019. The market responded positively as Uber’s share price jumped ~5% on the news (a 5% jump is about equivalent to the purchase price).

Our readers in India might not be familiar with Postmates. Postmates is a distant fourth player in the food delivery industry. Unlike UberEats, Postmates also delivers groceries and other items (Postmates powers Wal-Mart’s delivery service in select cities).

Several reasons why Uber bought Postmates:

- Acquisition of the fourth player in the industry is less likely to trigger regulatory scrutiny

- Consolidation can help drive costs down

- The acquisition can help Uber expand to deliver groceries and other consumer products

- Grubhub said no