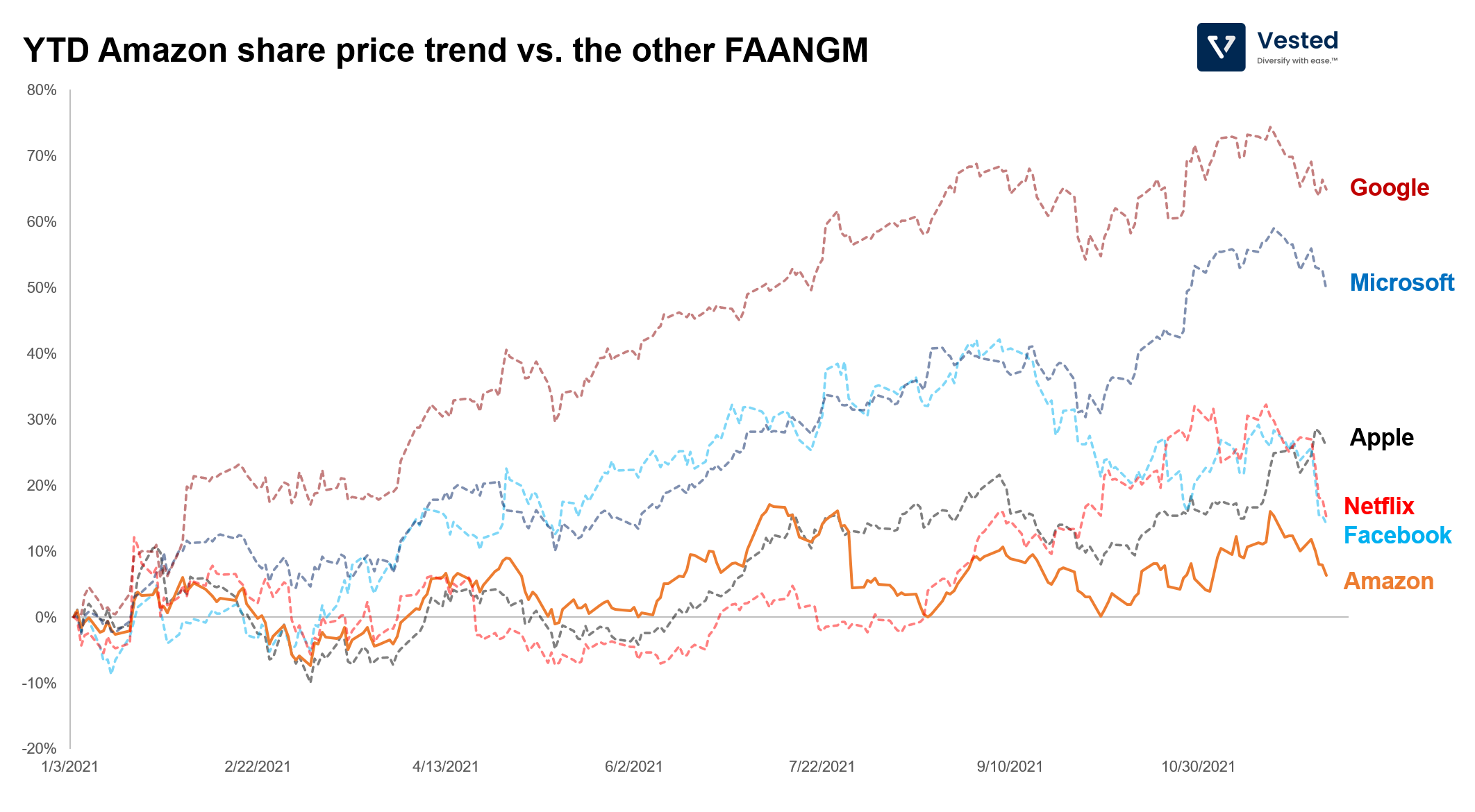

Amazon has underperformed the S&P 500 and other FAANGM companies in 2021

Amazon has been underperforming when compared to its FAANGM brethren (a handful of high performing mega cap tech companies: Facebook, Apple, Netflix, Google, and Microsoft, see Figure 1) and also when compared to the S&P 500 (which is up 23% YTD). The company’s share price is up only 5.7% YTD (as of this writing). Why is that?

Well, there are two reasons:

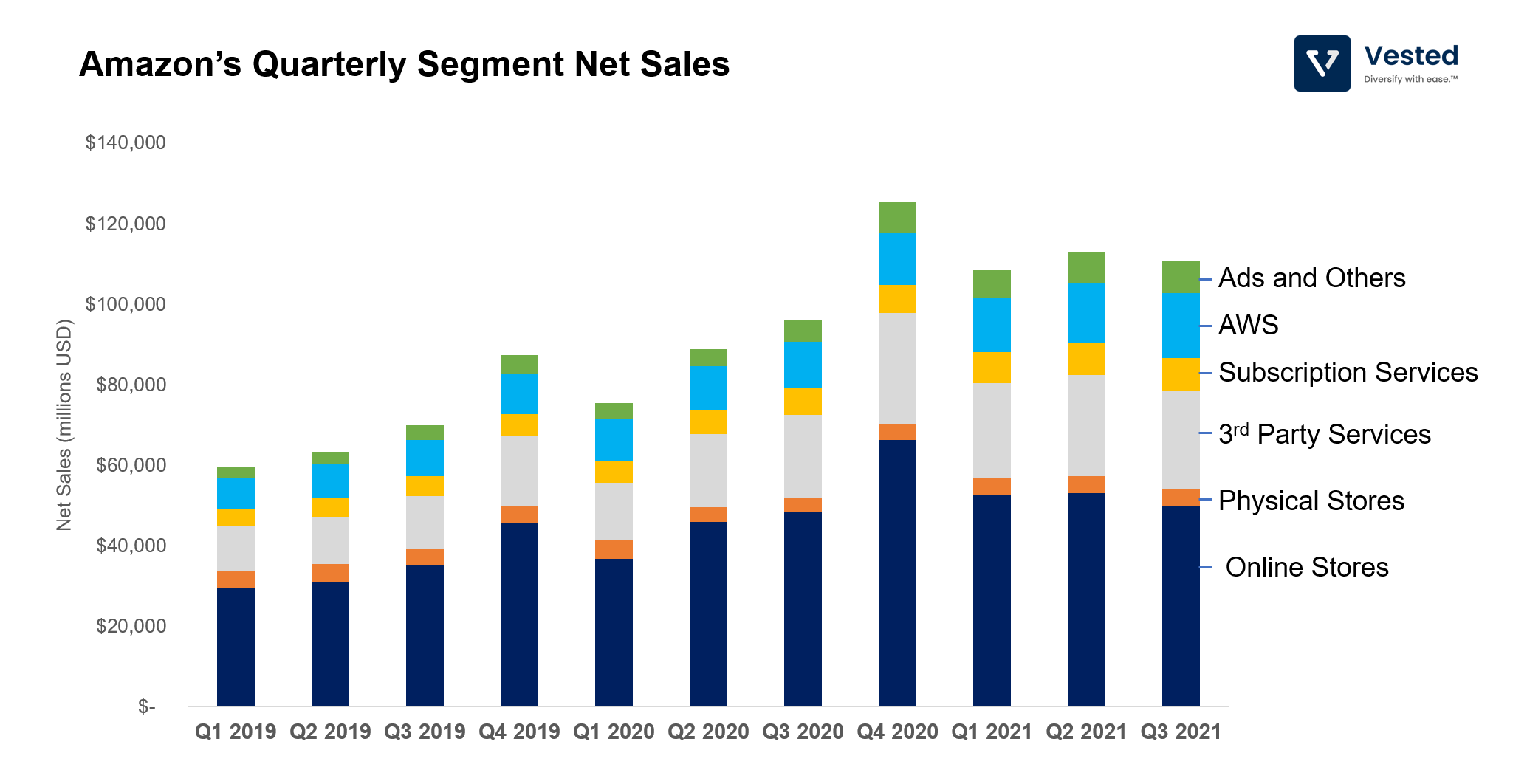

First, while revenue is up year-over-year, it has been largely flat in 2021. In Q3, the company earned $110.8 billion in net sales, up 15% over the same period from the previous year, but down 2% sequentially. Notice, however, that Amazon’s share price has been mostly stagnant for the better part of 2021 (even before the recent Q3 earnings announcement), which means there is likely a different cause for the flat share price growth. This leads us to the second reason.

Investors are worried about growth of expenses – especially in the face of the very tight labor market and increased inflation expectations – which can have a significant impact on the core ecommerce business.

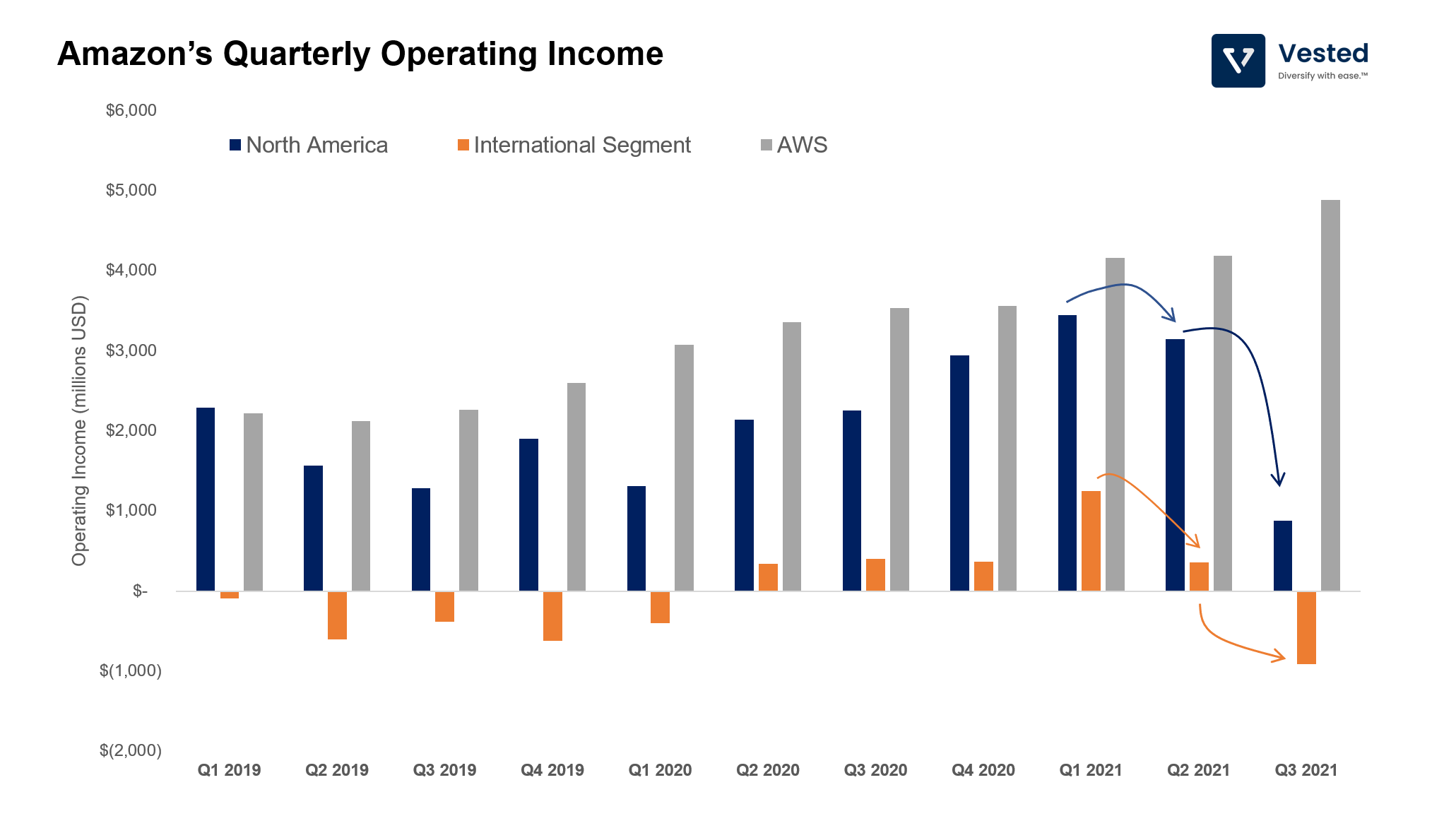

The cost inflation can be observed in the quarterly operating margin trends. The North America operating margin is down 72% sequentially. While the AWS segment continues to be a cash chow (up 16% sequentially, generating $4.8 billion in quarterly operating income), the international segment is no longer profitable (a return to pre-pandemic trends). See Figure 3.

Andy Jassy, Amazon’s new CEO, said that the company expects several billion dollars more of extra costs in Q4 2021. Despite the cost headwinds, Amazon is investing heavily to get ahead of the demand spike that it expects to happen during the peak holiday season. So expect the compression in margins to continue for several more quarters.

Having said that, Amazon cost increase is largely also due to increased investments in its logistical infrastructure.

Amazon is always preparing for the future

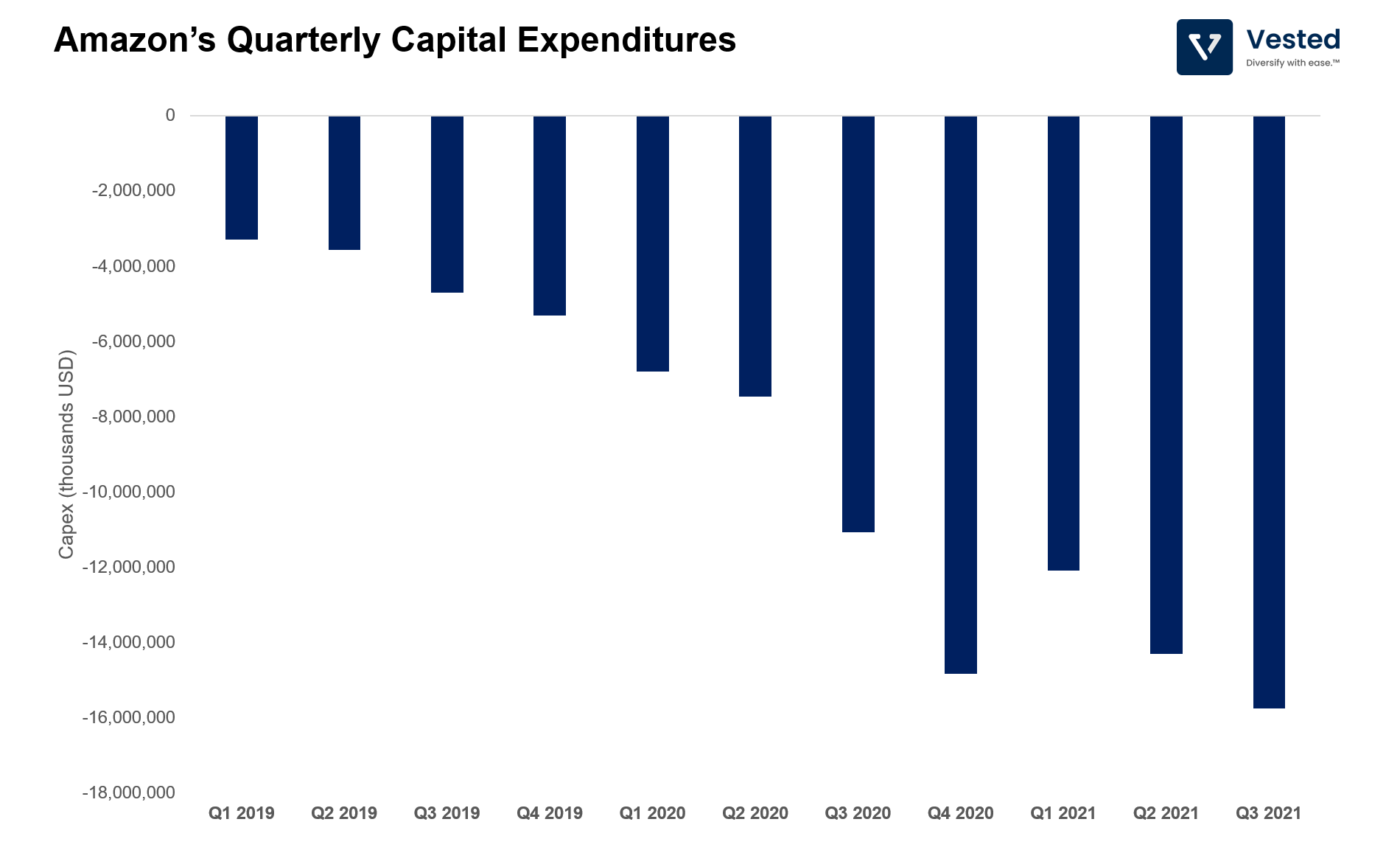

The increasing labor cost has not deterred the company’s investments in its logistical network. The company has about 1.5 million employees around the world, adding about 40% (or 570,000 jobs) in the past 2 years alone. The massive investment in distribution and fulfilment capabilities is reflected in its capital expenditures (Figure 4). The rate of capital spend in Q3 2021 is up almost five-fold (at $15.8 billion per quarter) when compared to two years ago. To put this rate of spending into perspective, in one quarter alone, Amazon spends more in CapEx than Walmart’s last five quarters combined (note: to be fair, Amazon’s CapEx spend includes cloud infrastructure spending. So it’s not quite an apples to apples comparison).

Why is Amazon doing this? The answer was outlined to investors more than two decades ago. Here’s a quote from Jeff Bezos’ early letter to shareholders (emphasis ours):

“I very frequently get the question: “What’s going to change in the next 10 years?” And that is a very interesting question; it’s a very common one. I almost never get the question: “What’s not going to change in the next 10 years?” And I submit to you that that second question is actually the more important of the two — because you can build a business strategy around the things that are stable in time. … [I]n our retail business, we know that customers want low prices, and I know that’s going to be true 10 years from now. They want fast delivery; they want vast selection.

It’s impossible to imagine a future 10 years from now where a customer comes up and says, “Jeff, I love Amazon; I just wish the prices were a little higher.” “I love Amazon; I just wish you’d deliver a little more slowly.” Impossible.

And so the effort we put into those things, spinning those things up, we know the energy we put into it today will still be paying off dividends for our customers 10 years from now. When you have something that you know is true, even over the long term, you can afford to put a lot of energy into it.

As you can see – the end goal is to accelerate delivery rates nationwide. After setting a new standard of shipping speed by establishing two-day shipping, in 2019, the company then promised one-day shipping for Prime members. But due to the unprecedented demand surge during the pandemic, the company struggled to keep up with volumes, and package shipping time suffered.

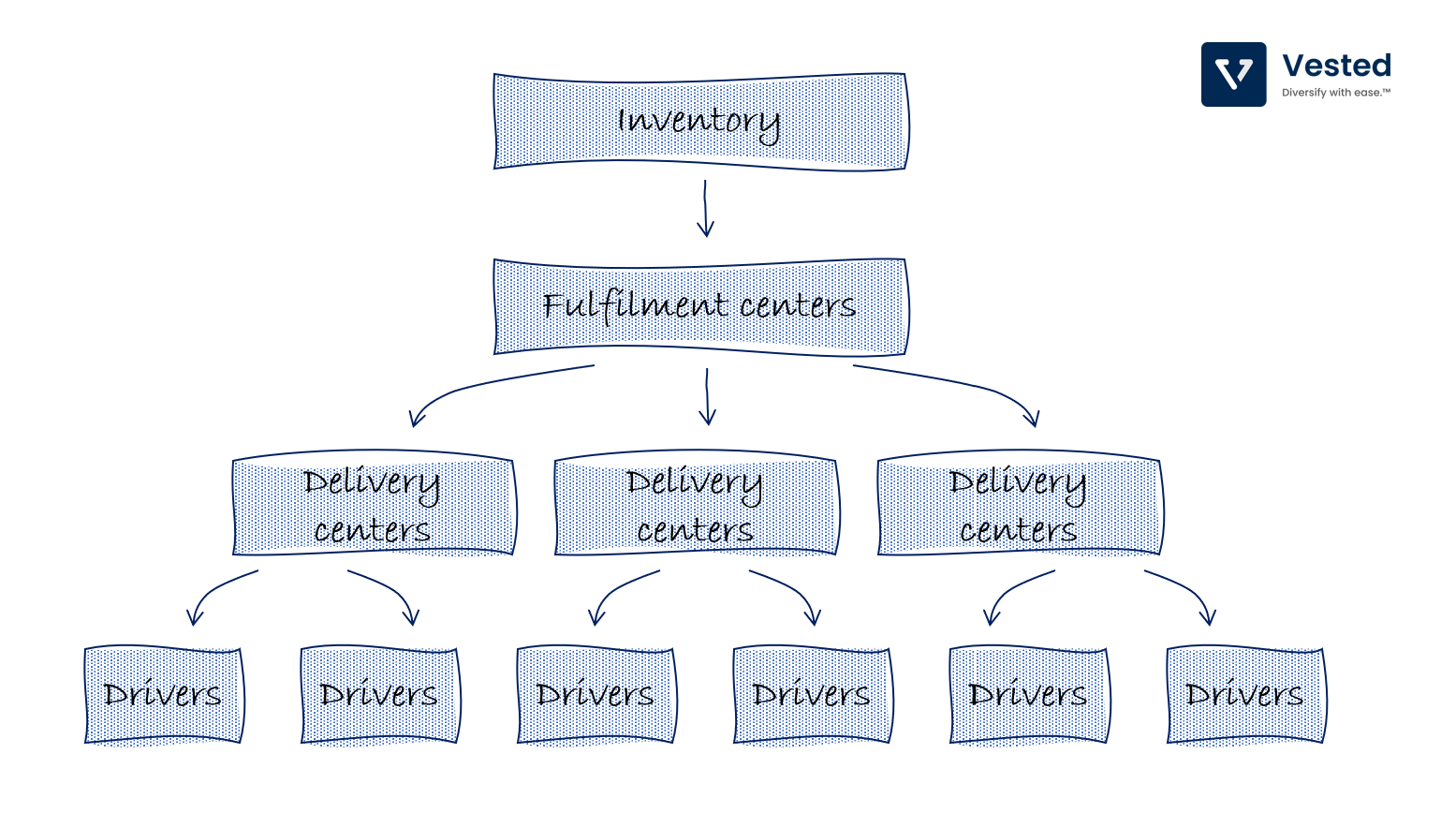

Nationwide one-day shipping is much harder to achieve than two-day shipping. To achieve the two-day shipping promise, Amazon developed its own air freight system. You can generally fly anywhere in two days. But to get to one-day shipping, the inventory has to be really close to the customers. This means that inventory levels must go up. You also need many more delivery trucks, which may require more sorting and fulfillment centers. This means that Amazon needs to re-engineer the way it delivers packages. Here’s a simplified view of Amazon’s current delivery system (Figure 5).

- Items from 3rd party sellers and Amazon’s own items are stored in fulfillment centers (each the size of 10 soccer fields). These are massive facilities, where items are picked and packed. To facilitate one-day shipping, over the past two years, the company has nearly doubled its fulfillment network to more than 930 facilities across the US.

- From fulfillment centers, items are sent to delivery centers. These relatively new types of facilities consist of smaller stations for last-mile delivery distributions. They are smaller (about 1/6th the size of the fulfillment centers) and are mostly designed to pass on packages to gig workers. Amazon is investing heavily in these new, smaller delivery centers since it discovered that using gig workers is critical in being able to scale up while maintaining lower costs. In 2019, there were a little over 150 of these facilities. That number more than doubled in 2020. When it’s all said and done – the company may have more than 1,500 delivery centers all over the US.

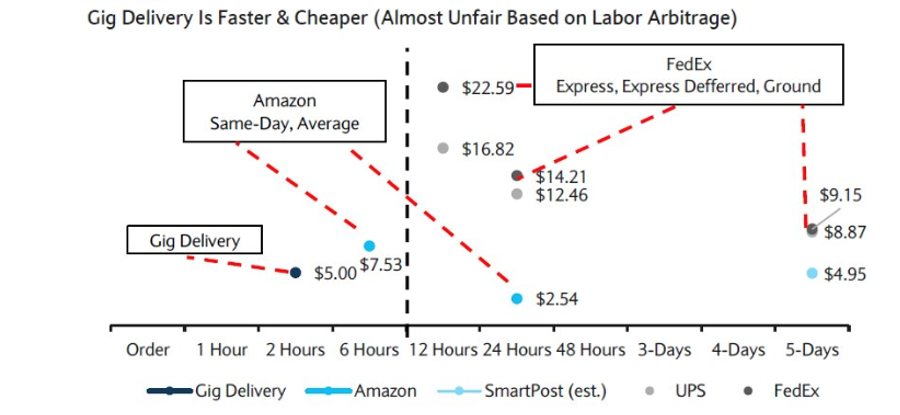

Two things stand out from this effort: (1) unprecedented scale – in the past three years alone, Amazon has grown its logistics network more than Walmart has grown its in the past 50 years; and (2) the use of gig workers (part of Amazon’s Flex program) as last mile delivery drivers. As you can see in Figure 6 – gig delivery is cheaper (thanks to labor arbitrage and the fact that Amazon does not have to pay for gas or health insurance).

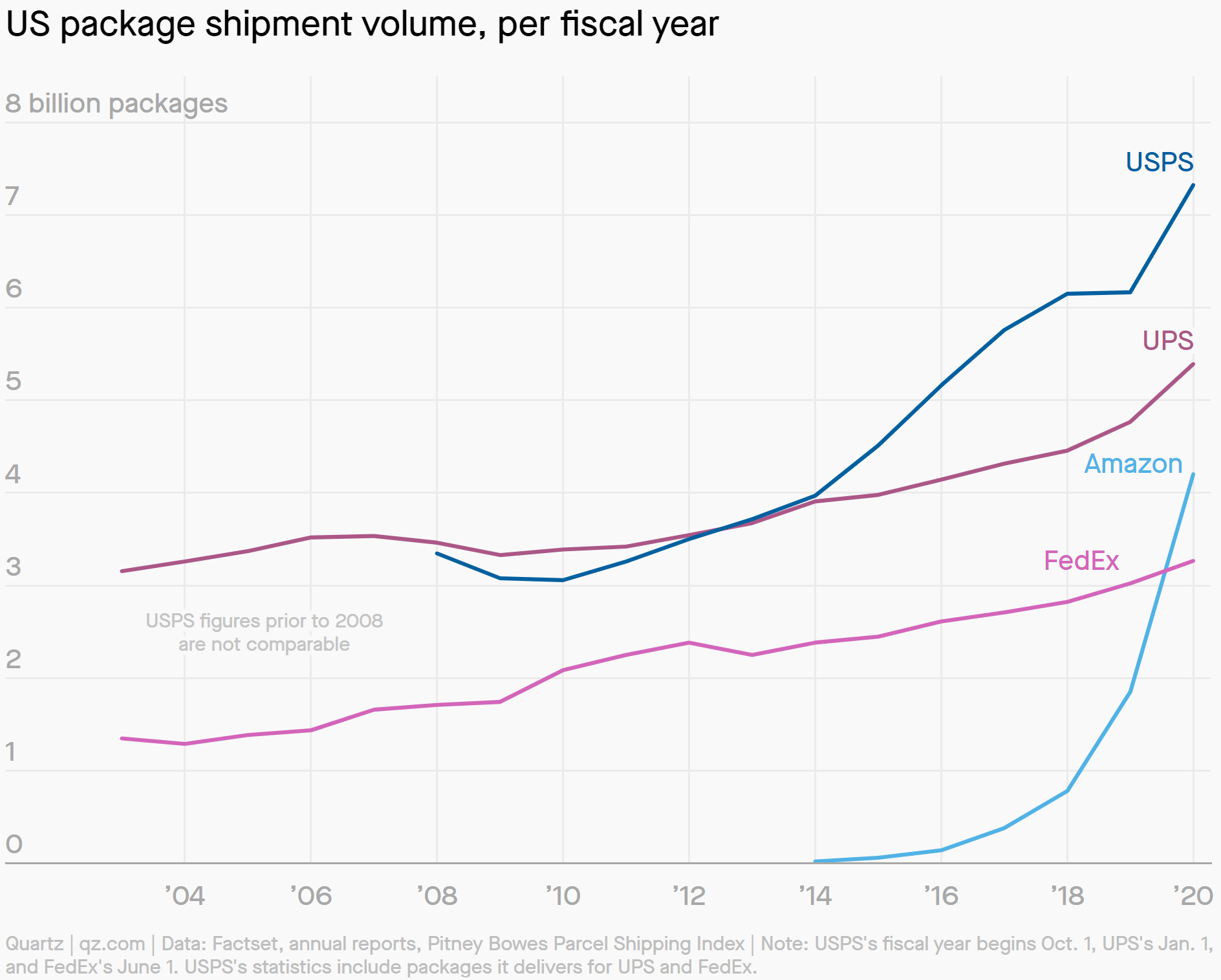

As a result of these massive investments, Amazon logistics is on track to be the largest delivery service, surpassing UPS, FedEx, and even the United States Postal Service (USPS) by 2022. To put it another way, Amazon’s internal logistical efforts will be bigger than that of two of the largest publicly traded logistic companies in the world and a US Federal Agency. See Figure 7.

One-day shipping accelerates Amazon’s flywheel

It’s human nature to want instant gratification. By shifting from two-day shipping to one-day, Amazon can further accelerate its business flywheel:

- Amazon can expand the items it offers to more perishable items (food and groceries, which, although has lower margins, are purchased very often).

- When items arrive almost instantly, you buy more often (on average, Prime members spend about 2x higher than non-Prime members annually).

- When Amazon has the most selection and can deliver the fastest, it becomes the default shopping destination. This reduces Amazon’s advertising cost (mostly spent on Google). In 2016, 55% of US consumers surveyed said that they start their product searches on Amazon. In 2020, this number increased to 74%.

- More organic traffic to Amazon means that the company can not only sell more of the stuff it sells, but it can also sell more 3rd party products. Currently more than 53% of sales on Amazon come from 3rd party sellers. These sellers pay Amazon to pick, pack, and ship their products, contributing to more than $24.3 billion in Q3 2021 (or 22% of revenue). These 3rd party sellers also advertise on Amazon, which makes Amazon the 3rd largest ad platform in the US by revenue (behind only Google and Facebook).

- 3rd party sellers increase selection even more, which further accelerates the above…

While it is true that the significant spending on logistics can improve the growth of its other businesses, considering the scale of its efforts, it is likely that Amazon will spin this into its own business segment. In the past, Amazon has turned cost centers into revenue sources (the company most famously did this with AWS). Currently Amazon is building the logistical service to serve its own needs. Once it has excess capacity, it will likely offer it to others. In fact, Amazon has been secretly transporting mail for USPS.

Thanks for reading. For a more in-depth breakdown of all the different businesses Amazon is in, please read for part 1) and part 2.