On to this week’s update:

- Tesla slipped after not being added to the S&P 500.

- The US IPO market is heating up again. AirBnB, Asana, Palantir and others have filed to go public in the coming weeks. We summarize the upcoming IPOs.

Tesla slipped after not being added to the S&P 500

After much speculation, the verdict is out. The S&P 500 committee has decided not to add Tesla (TSLA) to the index. The committee seems to be concerned about the company’s “profitability metric†and 2020 outlook. Tesla’s share price declined after news broke.

Being included in the S&P 500 index typically translates to a broader investor base for a particular company, as institutions and ETF providers are prompted to add the company’s shares to their portfolios. This tends to cause the share price to pop.

The committee instead selected Etsy and several other companies to be new additions to the index.

Upcoming Tech IPOs

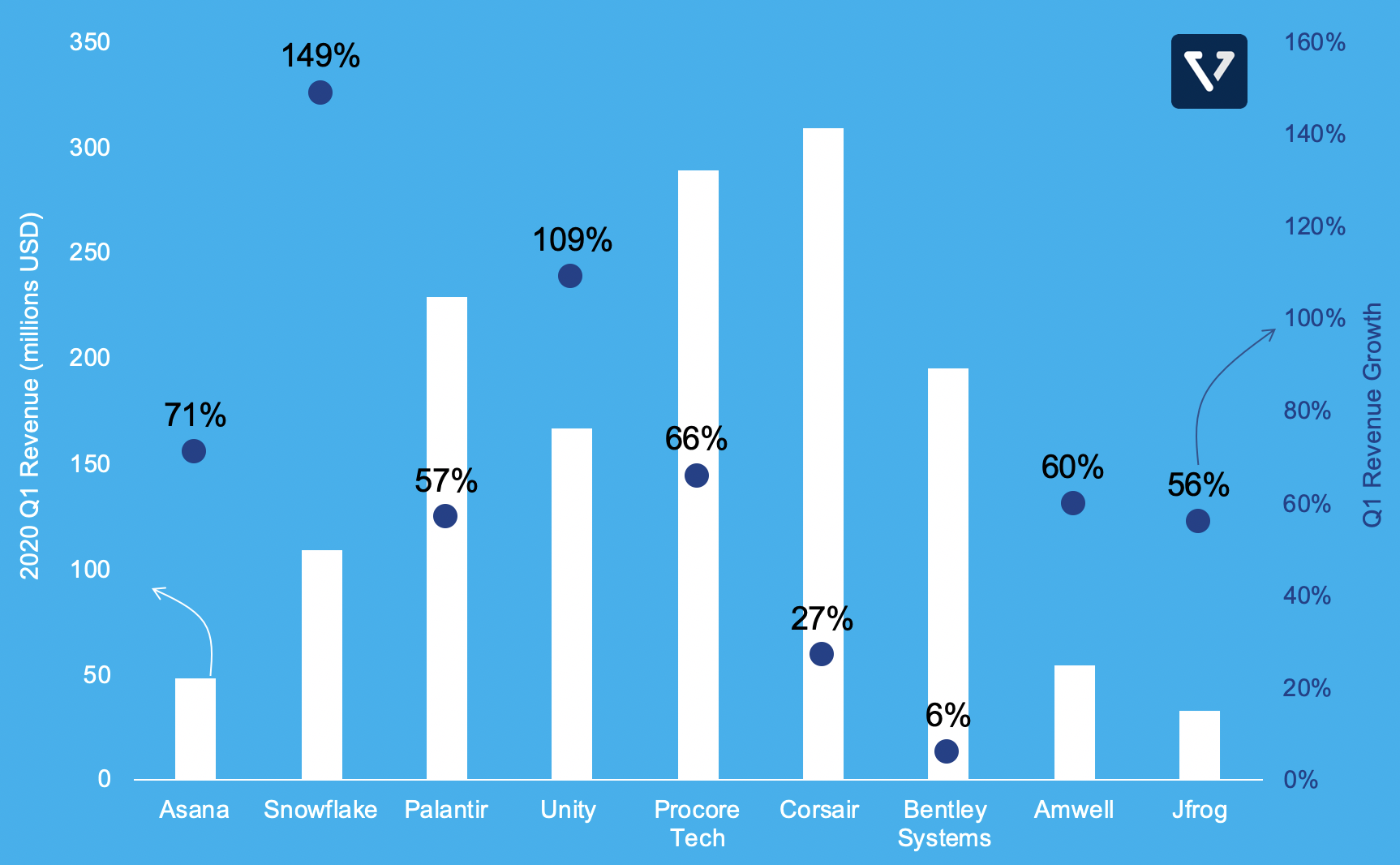

| Company | Description | RevenueQ1 2020 | Gross Margin Q1 2020 | Net Profit (Loss) Q1 2020 | Revenue Growth Q1 2020 vs. Q1 2019 | Net profit/loss growth rateQ1 2020 Vs. Q1 2019 |

| Airbnb | Rental online marketplace | $4B | ||||

| Asana | Work management app | $48M | 87% | ($36M) | 71% | Loss increased by 140% |

| Snowflake | Cloud-data platform | $109M | 61% | ($96M) | 149% | Loss increased by 12% |

| Palantir | Data analytics company | $229M | 72% | ($54M) | 57% | Loss decreased by 63% |

| Unity | Cross-platform game engine | $167M | 81% | ($27M) | 109% | Loss decreased by 22% |

| Procore Tech | Construction project management software company | $289M | 82% | ($83M) | 66% | |

| Corsair Gaming | Computer peripherals and hardware company | $309M | 25% | ($1M) | 27% | Loss decreased by 26% |

| Bentley Systems | Software development company for the construction and infrastructure sector | $195M | 81% | $30M | 6% | Profit increased by 48% |

| Amwell | Telehealth | $54M | (50%) | ($25M) | 60% | Loss increased by 17% |

| JFrog | Software development platform | $33M | 80% | ($2M) | 56% | Loss increased by 81% |

In Figure 1, we plotted the latest quarter’s revenue and revenue growth rates of the companies from the table above. For the most part, these companies are growing revenue rapidly, despite COVID-19 likely affecting their Q1 earnings. However, even among these fast growing companies, Snowflake stands out (more on Snowflake below).

A few notable highlights

Airbnb

It looks like the company will survive the global lockdown. After seeing its revenue plummet more than 90%, laying off 25% of its workforce, and experiencing its valuation slashed in half in April 2020 (latest private valuation was US$ 18 billion, about half of the valuation in 2017), the company is seeing a strong rebound in its business. Airbnb saw very strong growth in rural bookings, as people flocked outside large metropolitan areas.

The strong rebound in its business has allowed Airbnb to proceed with its original plan to IPO in 2020. Nonetheless, if it so chooses, the company can avoid an IPO altogether. Bill Ackman’s SPAC (the largest ever SPAC) has indicated interest in acquiring Airbnb. The discussion appears to have stalled, however.

Note: SPAC is short for Special Purpose Acquisition Company – a blank check company that raises funds from the public that is committed to merge with a large private company, and therefore bypassing the traditional IPO process for the private company. It’s all the rage of late – more information on SPACs in a future post.

Asana

Asana is a software-as-a-service (SaaS) company that creates work management tools, which should benefit from the shift to work-from-home. Founded by Dustin Moskovitz, co-founder of Facebook, the company plans to go public via direct-listing (insiders sell existing shares vs. a traditional IPO where the company issues new shares to raise fresh funds).

The founders plan to sell a portion of their shares during this process, and have pledged the proceeds towards philanthropic purposes.

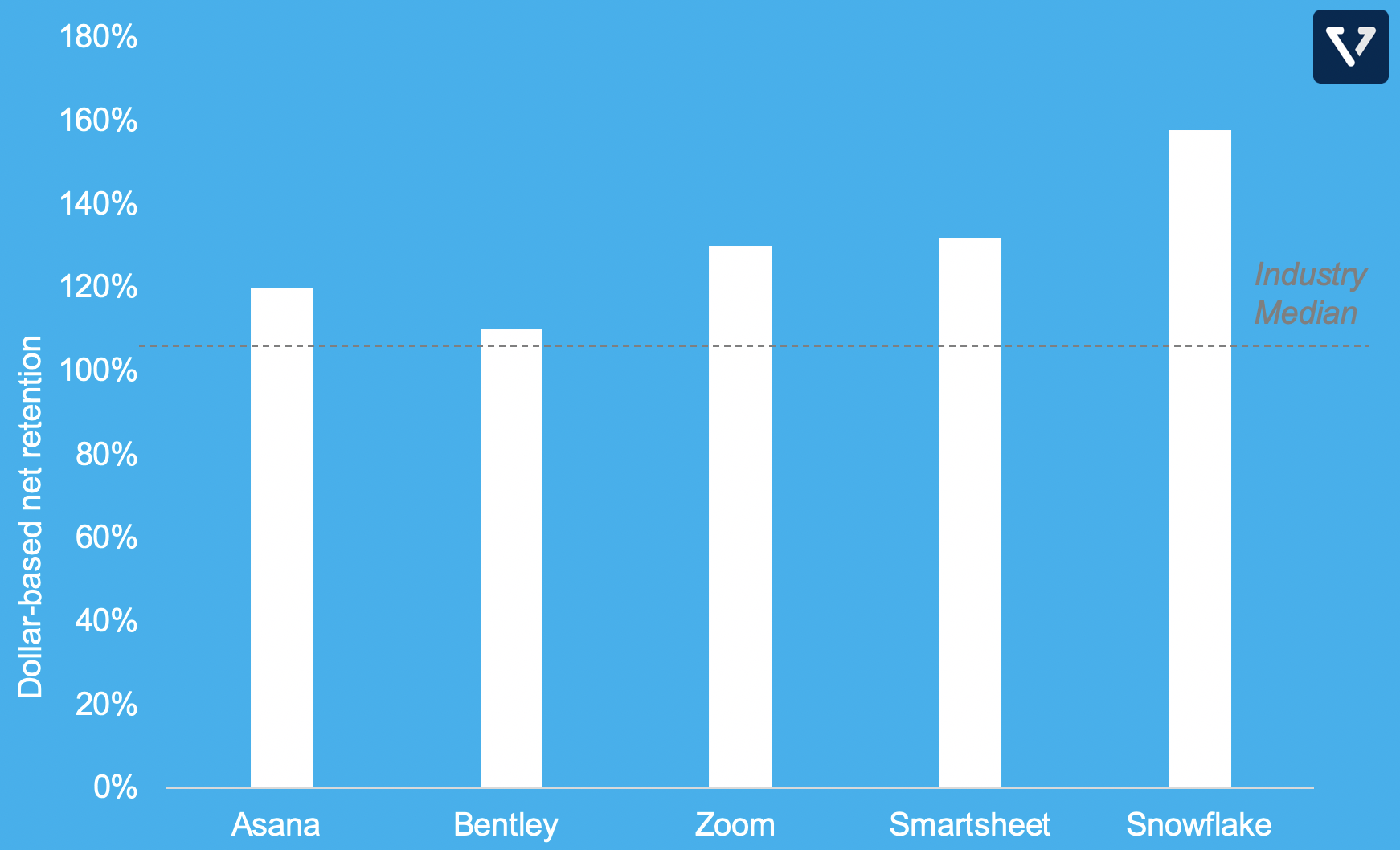

When evaluating a SaaS business, a useful metric is dollar-based net retention. This metric indicates how much more a typical customer spends one year after they become a customer. For example, if a customer joined in 2019 and spent US$ 100,000, a dollar-based net retention of 120% means that this customer in 2020 spends US$ 120,000. The customers spend more as they use more services. The higher the dollar-base net retention, the more efficient the business is, as the company does not have to spend sales and marketing dollars to grow existing revenue.

In Figure 2 below, we compare Asana’s dollar-based net retention with several other SaaS companies.

Palantir

Palantir is a 17 year old startup that was co-founded by Peter Thiel (who co-founded PayPal). It sells software and analytics tools focused on security.

During its long existence, the company has never reported a profit. It has 125 customers (and 28% of the company’s revenue is from 3 customers – so the customer concentration risk is real). And it will be going public via a direct listing, which means insiders can sell their shares without any lock out period. It is relatively uncommon for non-B2C (business to consumer) companies to go public via direct listing, as these types of companies do not have the brand recognition (unlike Slack and Spotify – who both went the direct listing route).

Snowflake

Snowflake is a data warehouse solutions provider. It allows businesses to manage data in the cloud. It does not build its own data center infrastructure. Rather, it builds its capabilities on top of infrastructure providers such as Amazon, Microsoft and Google. As a result, it spends heavily on paying infrastructure providers (mostly Amazon Web Services). As the company continues to grow, it is planning on investing heavily to build its own infrastructure to reduce costs.

The main story for Snowflake is that of growth. As you can see in Figure 1, among the companies listed here, it is growing its revenue the fastest. This growth is driven by its ability to expand usage of its software among its customers, leading customers to spending more, and resulting in a high dollar-based net retention rate (158% – see Figure 2 above).

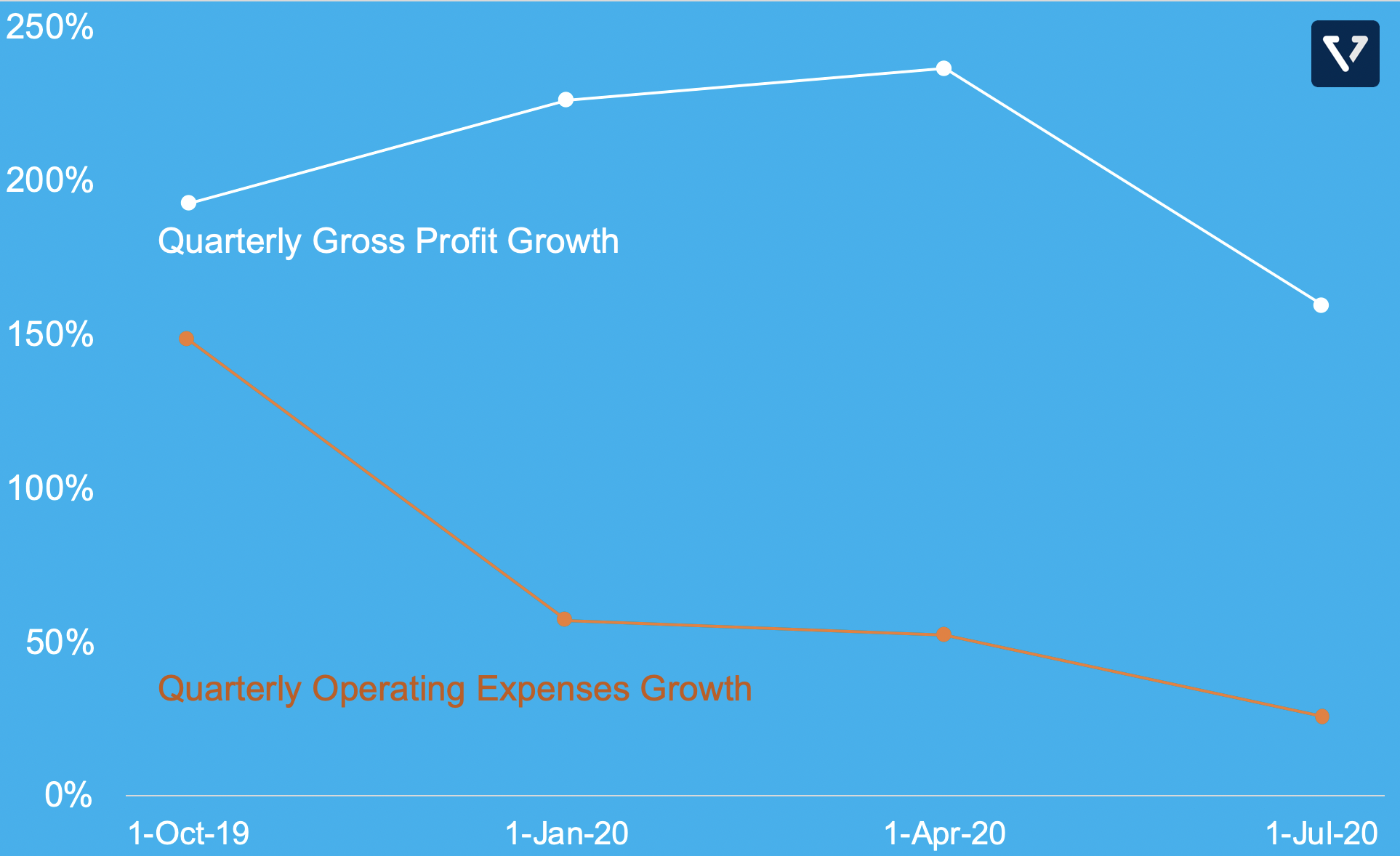

Furthermore, Snowflake’s gross profit is growing faster than its operating expenses (see Figure 3 below).

[mc4wp_form id=”1064″]