Investing in MNCs through their Indian subsidiaries – is it a good idea?

Many investors from India ask us: Why invest directly in the US stock market through Vested? Can’t we just invest in the Indian subsidiaries of these companies since they are publicly traded in India?

In this week’s update, we try to answer this important question (with data!).

Investors from India are attracted to invest in multinational corporations

To clarify the issue – Yes, Indian investors are able to invest in select multinational corporations (MNCs). They do this by investing in the Indian subsidiaries of these companies through the Indian stock market. Many invest in these Indian subsidiaries because they assume there is a higher level of governance, technological proficiency and transparency.

But, is investing in these Indian subsidiaries really better than directly investing in the parent US-traded companies?

Investing in Indian subsidiaries is often a more expensive proposition

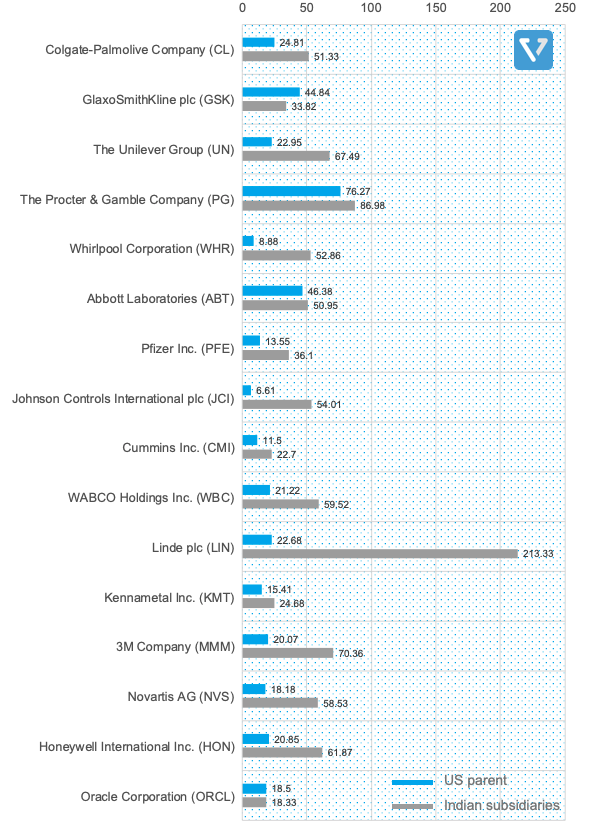

We looked at 16 MNCs that are traded in reputable US exchanges which have Indian subsidiaries that are publicly traded in India. The full list of the companies can be found in Figure 1.

Recall that investing means buying an ownership stake in a business. And how expensive the investment is (relative to others) can be measured by the P/E ratio. A high P/E ratio means that the investor has to pay more (in terms of share price) for every dollar/rupee the company earns.

Looking at the trailing twelve-month P/E (price over earnings from the last twelve months – P/E TTM), it is clear that the Indian subsidiaries tend to trade at higher (more expensive) multiples.

- Take Colgate-Palmolive for example, the parent company (ticker: CL) trades at 24.81 P/E TTM in the US, while its Indian subsidiary, Colgate-Palmolive (India) Limited (ticker: COLPAL.BO) trades at 51.33 in India, more than 2X higher.

- From this list, the smallest discrepancy is between Oracle Corporation (ticker: ORCL) and its Indian subsidiary, Oracle Financial Services Software Limited (ticker: OFSS.NS), which, unlike the parent company, focuses on software for financial services.

- The largest discrepancy is between Linde (ticker: LIN) and its Indian subsidiary, Linde India Limited (ticker: LINDEINDIA.BO). The parent company has a P/E – TTM of 22.7 in the US, while the Indian subsidiary is trading at a multiple of 213.33 in India. That’s a whopping 9.4X, likely because the share price of Linde India has been boosted by a potential delisting.

On average, investors from India are paying ~3X higher multiples (P/E TTM) when investing in the Indian subsidiaries vs. investing directly in the parent company in the US.

Are the higher multiples worth it?

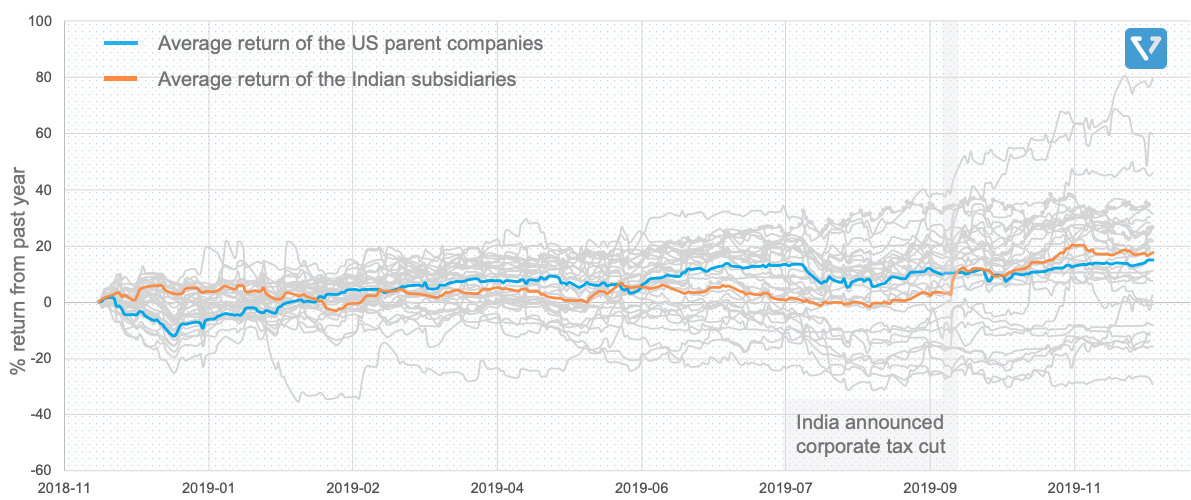

Typically, if you invest in companies with higher multiples, it is because of the promise of faster growth. But that is not the case here. Despite paying significantly higher multiples, the average returns from the past year are similar. The average past year returns of the US parent companies is ~14% (blue line in Figure 2), meanwhile the average returns of the Indian subsidiaries is ~17% (orange line in Figure 2).

In other words, data from the past year suggests that to invest in the subsidiaries of these MNCs, investors from India are paying 3X higher multiples, while enjoying only an additional 3% returns vs. the US (and this is likely driven by the Indian corporate tax cut which was announced in September 2019 – see Figure 2).

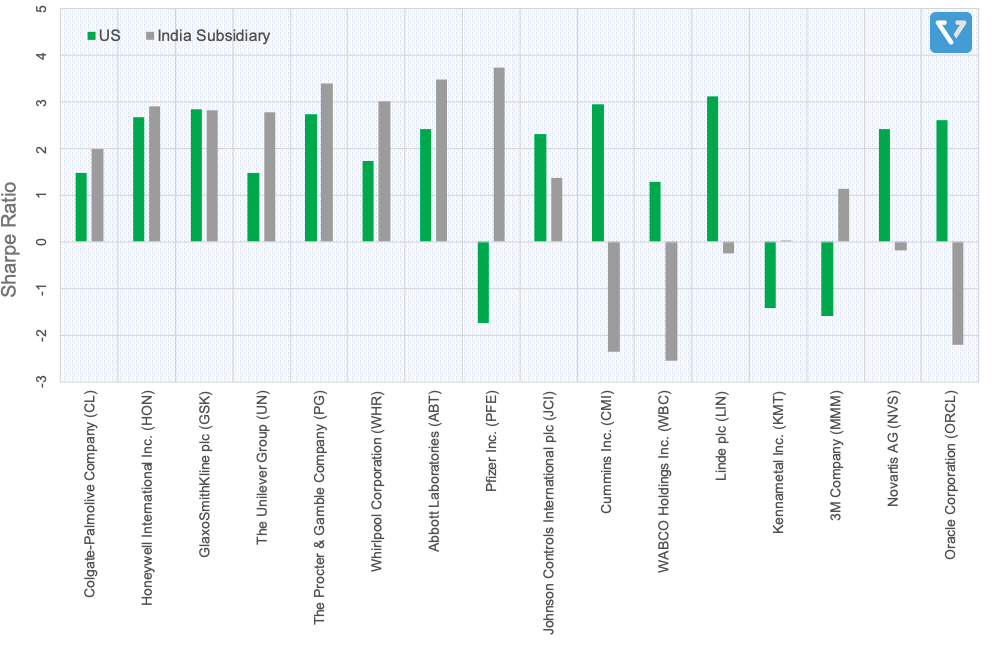

To make things worse, the share prices of these Indian subsidiaries are typically more volatile when compared to the US parent company. As a result, the Sharpe ratio(a measure of risk adjusted returns – the higher the number is, the better the expected return for the same risk) of the Indian subsidiaries are typically lower. GlaxoSmithKline is an exception to the companies listed here. The sharpe ratio for the US entity is matched to its Indian subsidiary (and notably, it is the only company from this list where the P/E multiple of the US traded entity is less than the Indian subsidiary – see Figure 1).

Ok, so back to our original question. Is investing in these Indian subsidiaries better than directly investing in the parent US-traded companies?

The data from the past year suggests that the answer is NO. Investing in the Indian subsidiaries can be a more expensive and more volatile proposition. If investors from India can get easy and relatively low-cost access to investing in the US-traded parent company – that might be a better proposition.