In Part I, we discussed the different factors investors can look for when making an investment decision (both quantitative and qualitative factors). In Part II, we will discuss two things: (1) the psychology of a value investor, and (2) the recent performance of Value Investing.

The Psychology of a Value Investor

1. Patience

When Warren Buffett was 11 years old, he bought 3 shares of Cities Service Preferred (for his sister and himself) at US $38 per share. Soon after, the price of the share fell to US $27. This frightened young Buffett. He held the shares, however, and when the price increased to US $40, Buffett immediately sold his position. This is something a lot of seasoned investors would have done. The irony is, after some time, Cities Service share price shot up to US $200.

This experience taught young Buffett a very important lesson: in investing, patience is key. Value investing does not give you instant gratification. You should be investing with a long time horizon.

2. Strong discipline

Value investors can be quite the contrarians. They sometimes buy when everyone is selling and sell when everyone is buying. They don’t go after stocks that are trending unless the underlying business is sound. This means they do not buy into the hype when investing. The opposite is also true. During the market selloff, a value investor would not be easily swayed to sell off good investments.

Is Value Investing Still Relevant Today?

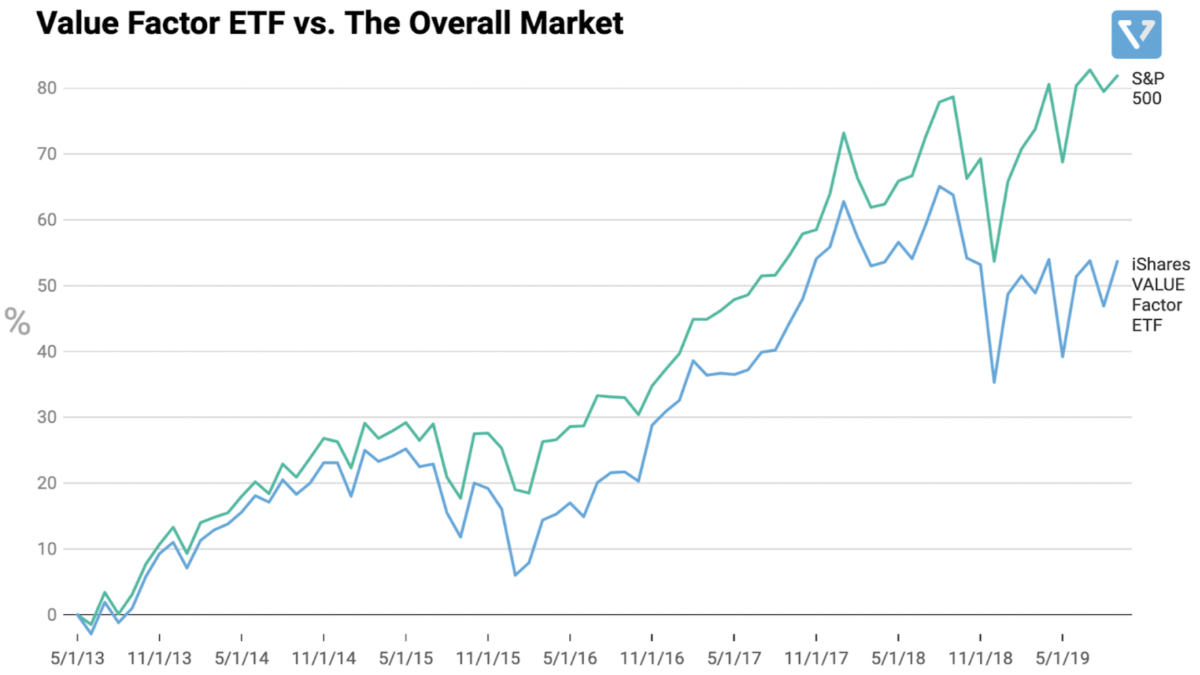

In recent years (Figure 1 shows data from the past 6 years), value investing has lagged behind the growth of the overall market (S&P 500).

Figure 1: iShares Value Factor ETF vs. S&P 500

This primarily is due to the following:

1. Low-interest environment

After the great recession in 2007, the US Federal Reserve started its quantitative easing program (a program that injects a lot of cash into the economy) and lowered interest rates to inject liquidity into the contracting US economy. This fundamentally affected how investors would evaluate the value of a stock. Low-interest rates translates to low discount rates for projected future earnings and cash flows. This has the unintended side effect of further boosting valuations of companies that are expected to deliver robust growth farther into the future. This phenomenon creates a feedback loop, where fast growing companies get a lot of growth momentum, trade at a higher valuation, grow their stock prices faster, attract more investments, and increase the share prices further.

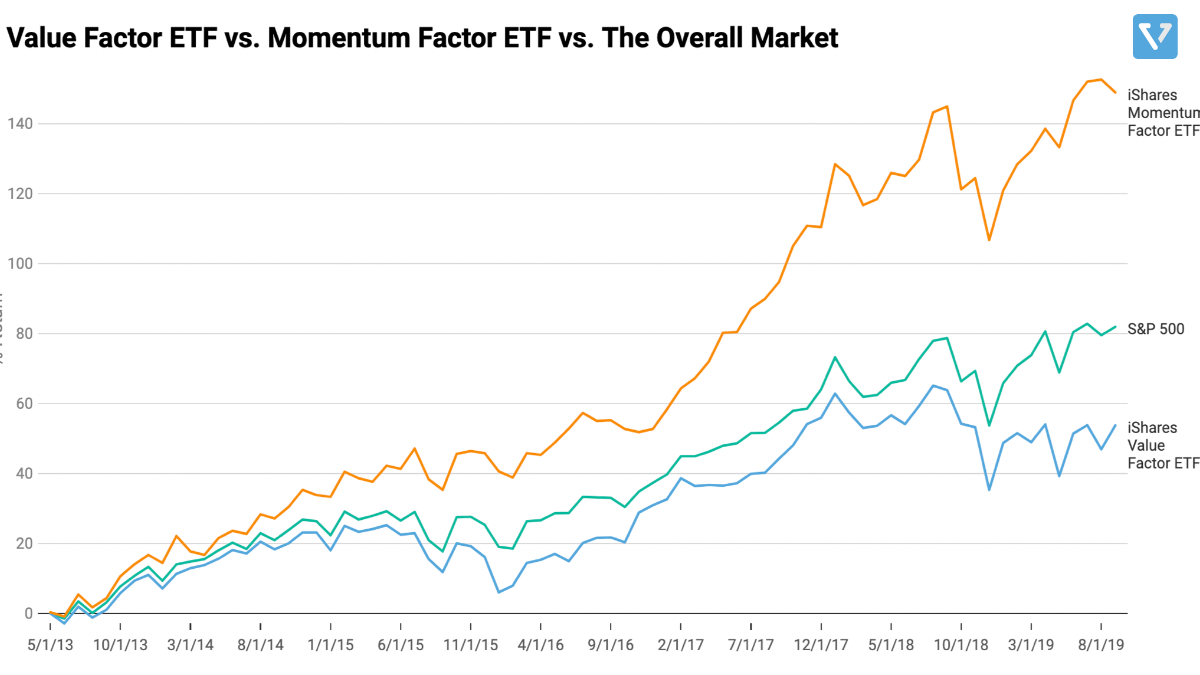

As a result, in the recent years (data from past 6 years is shown in Figure 2), momentum-based investing (represented by iShares’ Momentum ETF [ticker: MTUM]) has outperformed not only value investing (represented by iShares’ Value ETF [ticker: VLUE]) but also the broader S&P 500.

Figure 2: iShares Value Factor ETF vs. iShares Momentum Factor ETF vs. S&P 500

2. Harder to value intangible assets

The increasing importance of digital technology has fundamentally shifted companies’ valuations. If you recall from Part I, one of the key quantitative metrics is P/B ratio (market value divided by asset value). The traditional way of assessing asset value is to measure only tangible assets (e.g. equipment, factories). It is much harder to accurately measure intangible assets (e.g. brand, patents, data). However, in the age of digital economy, intangible assets play an increasingly more important role.

Despite this, money spent on intangibles is written off as expenses, and as such not reflected in the book value. In fact, 84% of the S&P 500’s market cap comes from intangible assets. As a result, the P/B ratio is becoming increasingly inaccurate.

3. Technology disruptions

One key philosophy of value investing is finding a company with a good, defensible business. This is increasingly hard to do as technology disruption is accelerating. In 1965, the average tenure of a company in the S&P 500 was 33 years. By 1990, it was 20 years, and by 2026, it is forecasted to go as low as 14 years. As a result, it is becoming more difficult to find companies with an enduring business advantage.

Is Value Investing Completely Pointless Then?

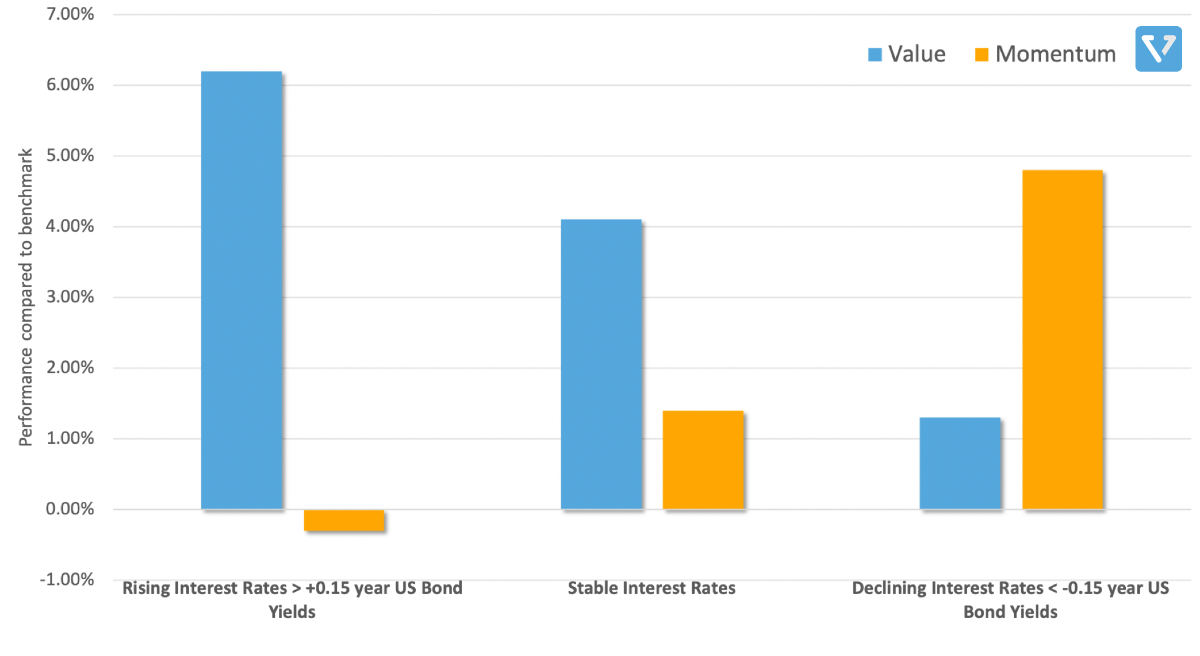

On the contrary, its basic principles is applicable to the current investing paradigm. It is critical for investors to understand that the current condition of high debt and low interest rates is simply unsustainable. Investing environments come and go in cycles, and when market conditions shifts again, value may regain its advantage. Figure 3 shows the cyclicality of the two investing styles: value outperforms when interest rates are increasing or stable, whilemomentum is favored when interest rates are declining.

Figure 3: Cyclicality of different investing styles. Value outperforms when interest rates are increasing or stable, while momentum is favored when interest rates are declining.

Despite the recent underperformance of value investing, the core principles are timeless. A savvy investor can apply the methodology discussed here to select businesses and companies to invest in. The framework one develops when value investing, combined with the necessary temperament one needs to be a good investor, can help when investing in any market environment.

Also remember to diversify your methods of investing. Since it is difficult to predict changing market conditions, it is best to diversify your investing methods: invest not only in value, but also in momentum, quality, low volatility factors. Stay tuned for more from us on this.