Apple was one of the best performers in 2019. The company announced its earnings for the the holiday season of 2019.

The Good News

Powered by stronger than expected iPhone and Wearables sales (which jumped 37% from the same period last year), Apple reported US $91.8 billion in quarterly revenue, which is 9% higher than from the same period last year.

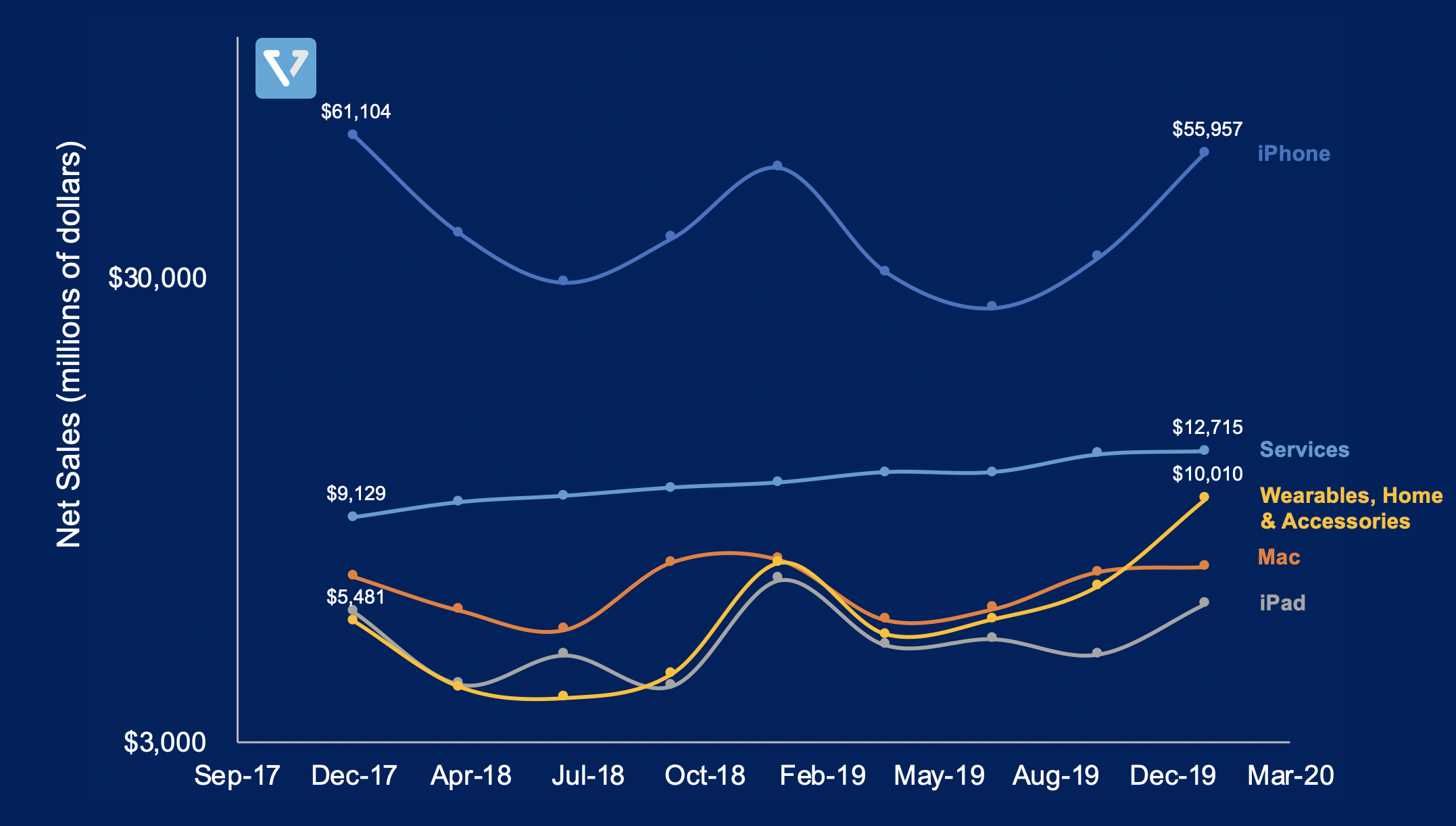

Apple categorizes its revenue into Products (iPhone, Wearables & Accessories, Mac, and the iPad) and Services. In Figure 1, we plot the quarterly Net Sales of these businesses, and as you can see, the iPhone (dark blue line) and Wearables, Home & Accessories (yellow line) businesses exhibited strong growth. Strong growth was specifically observed on the Wearables product line, which grew 44% according to Tim Cook, driven by the Airpods Pro and the new Apple Watch sales.

Apple’s Strategy

Apple’s strategy is simple (we wrote about it here before): as the iPhone becomes a more mature product (Tim Cook touted more than 1.5 billion user install base), Apple will extract more revenue from its users by selling peripheral devices (Apple Watch, Airpods, etc) and services (music, TV, news, payments, and the App Store).

The reason for this strategy is three-fold:

- More revenue per user: This strategy allows Apple to gain more revenue as the market has become mature and hardware upgrade cycles continue to increase.

- More predictable revenue: Apple’s hardware sales are seasonal, with the holiday season being the strongest. In contrast, the revenue from Services is very predictable, due to the nature of recurring subscription business. You can see this in Figure 1, where Net Sales from hardware-based products vary from quarter to quarter, peaking in quarters ending in December; while sales of Services is highly linear.

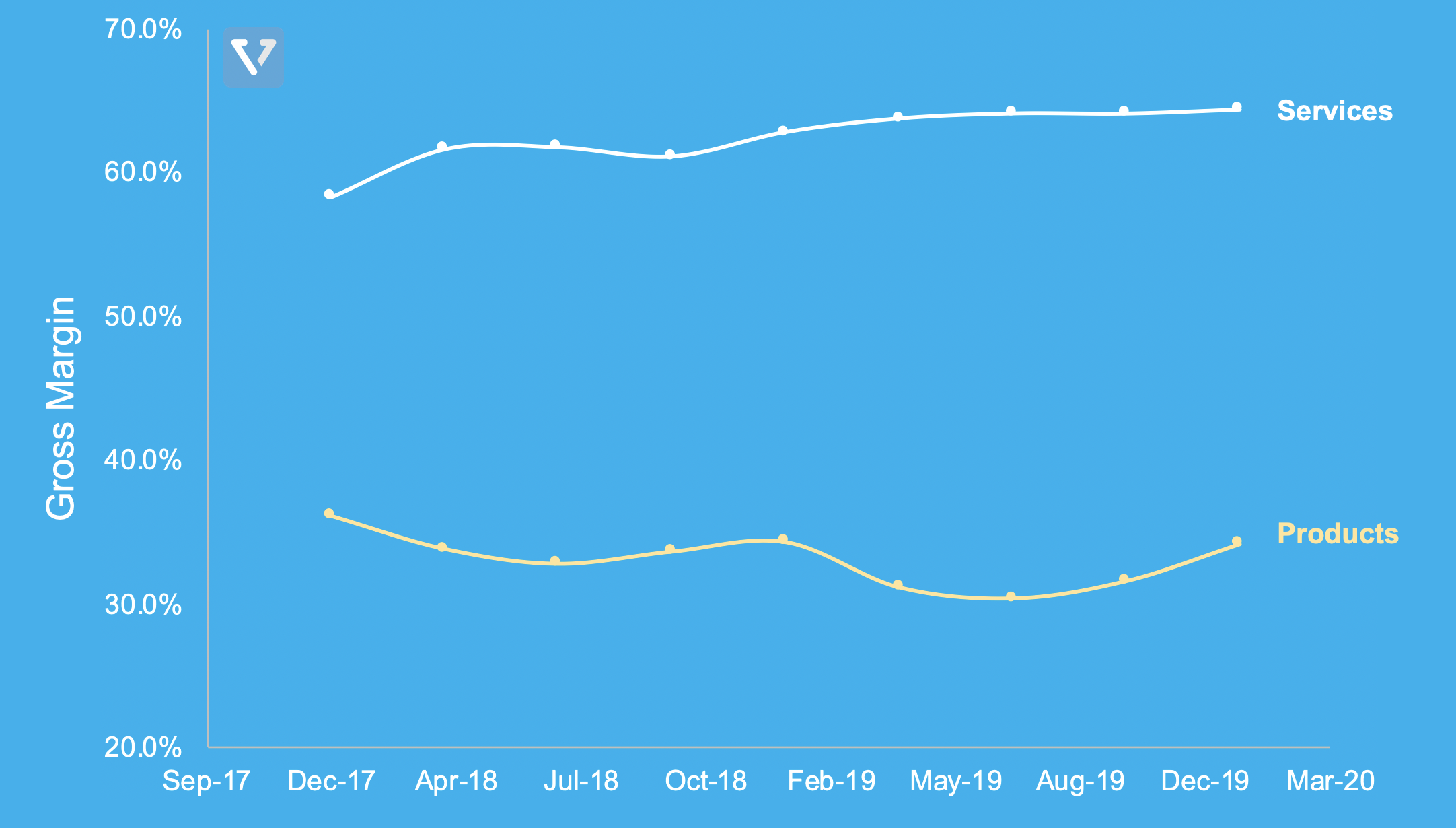

- Services are more profitable: As Apple transitions to a services-based business model, its profit margin should go up. The services business is more profitable than the hardware business. In the last quarter, Apple’s services yielded a gross margin of 64.4%, while products yielded 34.2%. In fact, over the past nine quarters, the gross margin of Apple’s hardware products has been declining. Services help counteract this pressure.

The Problem With This Earnings Report

The problem with this latest earnings is that it does not fit Apple’s services narrative. The reason earnings jumped beyond expectations this quarter is because Apple beat investors’ expectations in hardware sales. Services growth was actually below expectations. It grew 17% year-over-year, but is almost 3% below analysts’ expectations. This miss might be due to softer than anticipated growth of Apple’s TV streaming service.

Apple’s share price rally in the past year could be attributed by the fact that investors are starting to evaluate Apple as a software and services company (even though the iPhone is still responsible for 61% of the company’s sales). Figure 3 shows Apple’s share price as a multiple of forward earnings (P/E). As you can see, Apple is trading at an all-time high multiple, comparable to all high-gross margin software companies: Microsoft, Alphabet (Google) and Facebook. Therefore, weakness in Services growth could be bad for the evaluation of the company.

Nonetheless, the company is optimistic about its prospects in the upcoming quarter (ending in March 2020). It gives guidance that is relatively positive, with a revenue ranging between US $63 billion to $67 billion (Apple made US $58 billion in the same period last year). This guidance range is wider than what the company typically offers, however, due to the unknown impact of the coronavirus outbreak in China, which can be two-fold:

- Apple faces a supply chain risk, since its manufacturing capacity is concentrated in China.

- Apple also faces revenue risk, as ~15% of the company’s revenue comes from China.

The Delicate Balance

There is an inherent tension in Apple’s business models. When selling hardware products, Apple optimizes for great user experience (which often means exclusive software and hardware that is not interoperable with others) and brand (hence the high average selling price). Historically, Apple has not strived for the widest adoption possible. In contrast, for a subscription software business model, one typically wants the highest adoption possible, which means that the service should be able to be consumed on any platform. For example, in 2007, Netflix built its own streaming hardware – only to spin it out as Roku (which currently has a US $15 billion market cap) – because the company wanted to ensure that Netflix would be available in all platforms and did not want to complicate its relationships with existing hardware makers.

Fortunately, Apple has become so dominant, that it has a more than 1.5 billion user base that can be its first customers. Nonetheless, as the company transitions to the Services business model, it will try to expand its user base further (by lowering the average selling price of its devices). Bloomberg reports that currently, the iPhone’s average selling price is US $759.85, a year-over-year decline of 2.3%. The company is also planning on launching a new lower-cost phone to cater to consumers in India as early as March 2020.

That said, the iPhone becomes the spearhead into Apple’s ecosystem, and as Apple’s user base expands (it currently has a 480+ million user base and is targeting to reach 600 million by 2020), it can continue to sell more iPhone accessories and Services to its existing user base at a lower customer acquisition cost, leveraging its very strong brand loyalty.