Today, we discuss businesses that employ low- margin businesses to generate high-margin revenue

Last week, we discussed how Costco was able to convert a low margin retail business into a profitable recurring subscription business. Today, we continue our discussion on businesses that employ low-margin businesses to generate high-margin revenue, specifically: (1) one of the largest real estate companies in the world masquerading as a burger chain, and (2) a food delivery and supply chain giant masquerading as a pizza chain.

One of the largest real estate companies in the world: McDonald’s

Brothers Richard and Maurice McDonald opened the first restaurant bearing their names in San Bernardino, California, 1940. Their early innovation was the application of assembly-lines in fast food production, which enabled them to reduce variability and increase consistency in the food they produced. This in turn reduced costs and time for preparation. But the transformation of McDonald’s into a franchise corporation did not happen until Ray Croc came in 1955 (as chronicled in the movie, The Founder).

Currently, McDonalds offers similar menus in more than 122 countries: the same Big Mac, milkshakes, and golden fries cooked to perfection (with a little help from chemical agents). McDonald’s is so ubiquitous that its burger is used as a measure of purchasing power parity between different countries (see the Big Mac Index).

But we are not here to discuss McDonald’s food, we are here to talk about how the company makes money.

You can’t build an empire off a 1.4% cut of a 15-cent hamburger – you build it by becoming a real estate empire

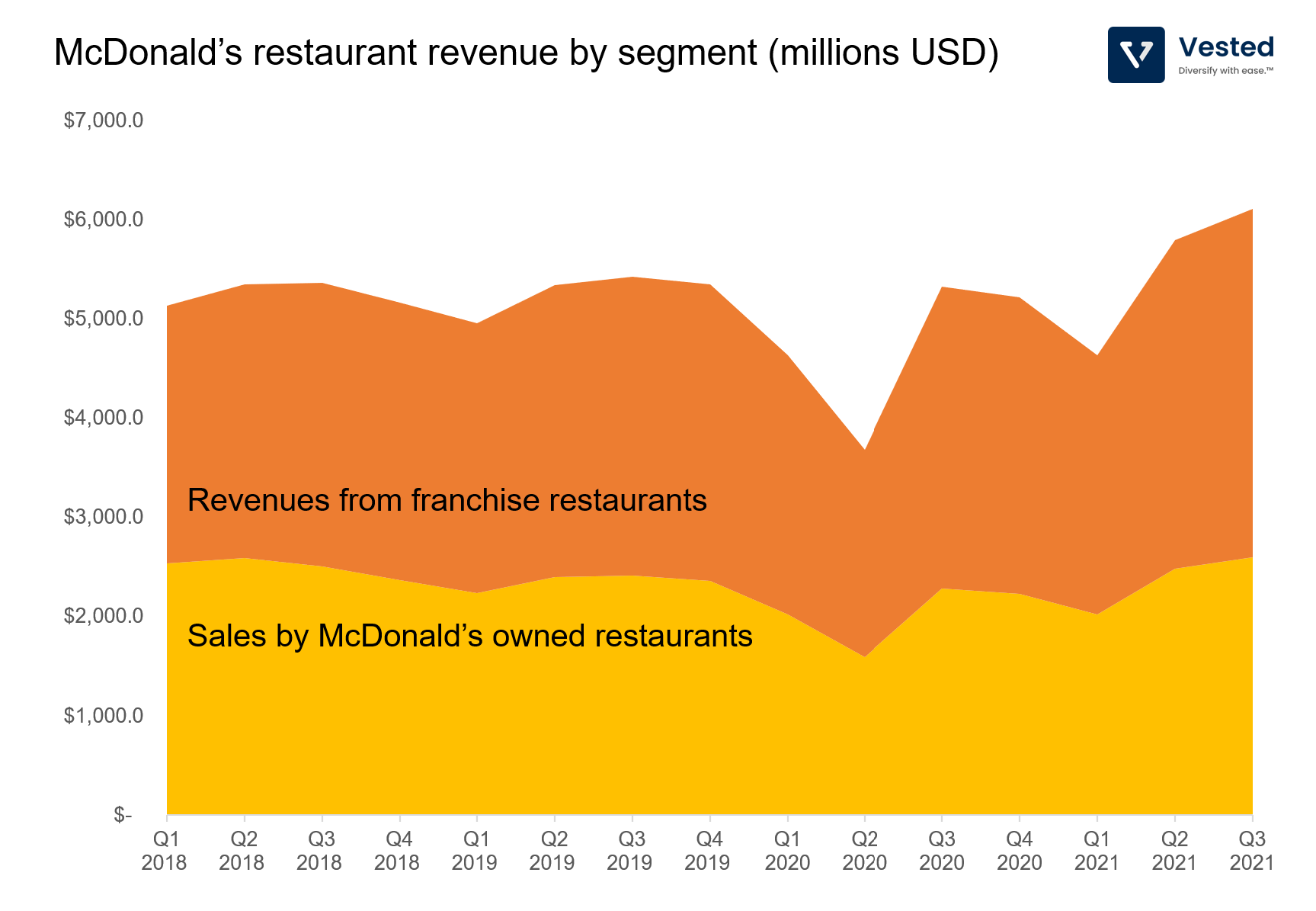

The modern day McDonald’s generates its revenue primarily from two sources: (1) sales from its own restaurants and (2) revenues from restaurants owned and operated by its franchisees. See Figure 1 for the quarterly trend from the past 15 quarters. As of the last quarter, the company generated 42% revenue from its own restaurants and 57% from franchised restaurants (not owned by the company).

By the end of 2020, there were more than 40,000 McDonald’s globally, of which, 93% were not owned by the company (although the company does not own those restaurants, it owns most of the land the restaurants are built on). There are two reasons why the vast majority of restaurants are not owned by the company:

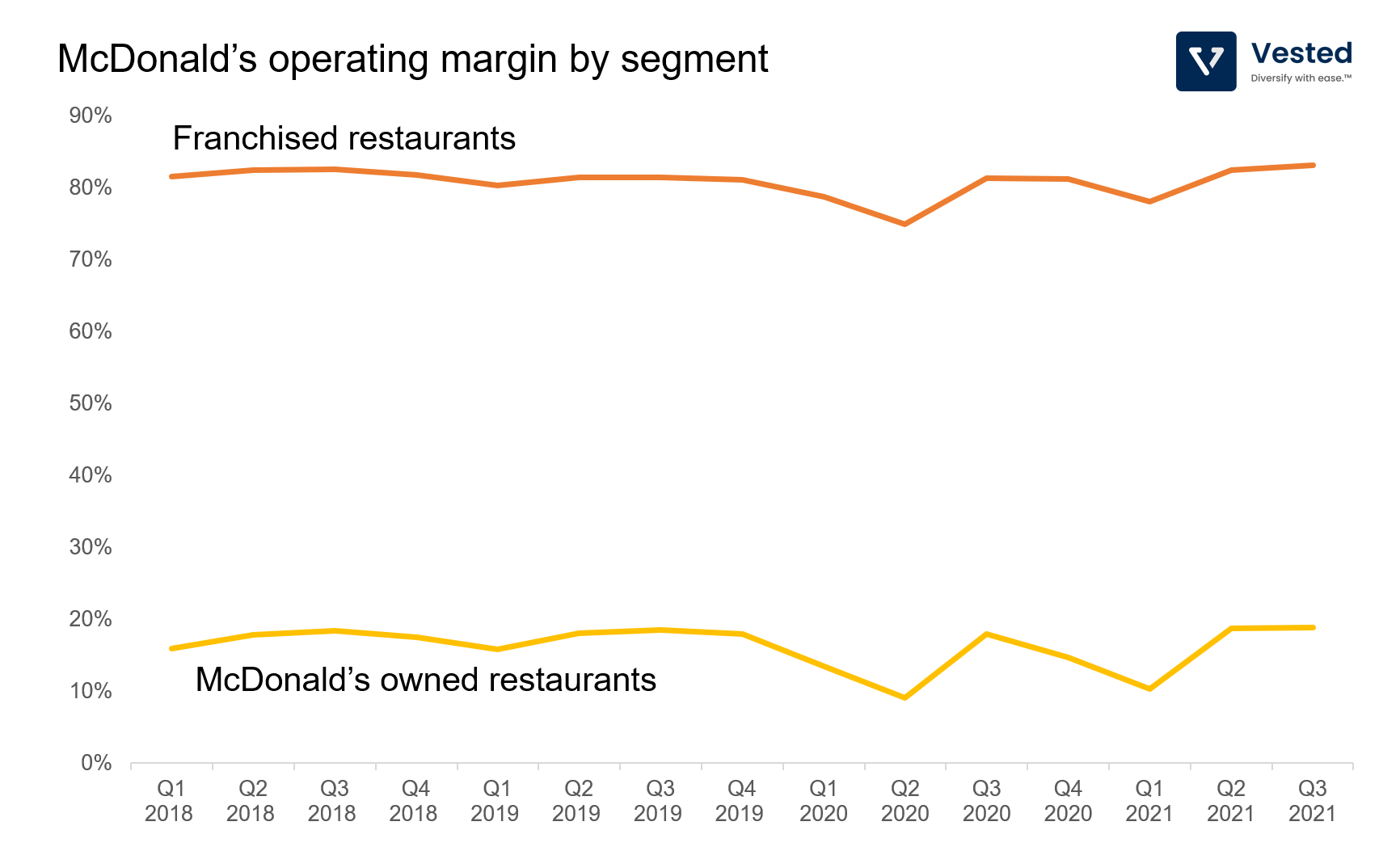

The first reason is that although the revenue per store is much smaller for franchised restaurants, these restaurants are far more profitable. See Figure 2 for the quarterly trend of operating margins. Franchised restaurants generate ~82% operating margins vs. ~19% for company operated restaurants.

McDonald’s charges its franchisees ~15% of gross sales for services and rent. The rent is the largest component of the high-margin revenue. As a global company, with more than $40 billion in real estate portfolio, McDonald’s can acquire highly sought after locations and negotiate low cost long term leases on behalf of its franchisees. It then charges franchisees rent in the form of a cut of gross sales. In other words, McDonald’s converts fixed investments into variable revenue. The whole purpose of the food it sells is to generate rent on land it owns. It’s a REIT wrapped as a restaurant business.Â

The second reason is that revenue from rent is a more stable cash flow than revenue from food. At the eve of the global lockdown, revenue dropped. From Q4 2019 to Q2 2020, sales from its own restaurants dropped 32.6%, while revenues from franchised restaurants dropped by a lesser degree (30%). However, even when there’s no sales, franchisees still need to pay rent. The rent revenue also begins when the restaurant is being built by the franchisee, giving McDonald’s immediate cash flow for further expansion.

So why bother operating its own restaurants? In 1988, a Microsoft manager sent an email to his team titled “Eating our own dog foodâ€, encouraging them to use its own products in order to improve the quality of the product. In tech, the preferential attitude to use your own product is called dogfooding. McDonald’s treats their own stores as their version of eating their own dog food. From its annual report:

“Directly operating McDonald’s restaurants contributes significantly to our ability to act as a credible franchisor. One of the strengths of the franchising model is that the expertise from operating Company-owned restaurants allows McDonald’s to improve the operations and success of all restaurants while innovations from franchisees can be tested and, when viable, efficiently implemented across relevant restaurants.â€

Technology driven delivery company masquerading as a pizza company – Domino’s Pizza

Another company operating in the restaurant business that has been able to achieve higher margins through an orthogonal business is Domino’s. We previously talked about the global pizza chain. In that article, we argue that it’s the first at scale profitable ghost kitchen company.

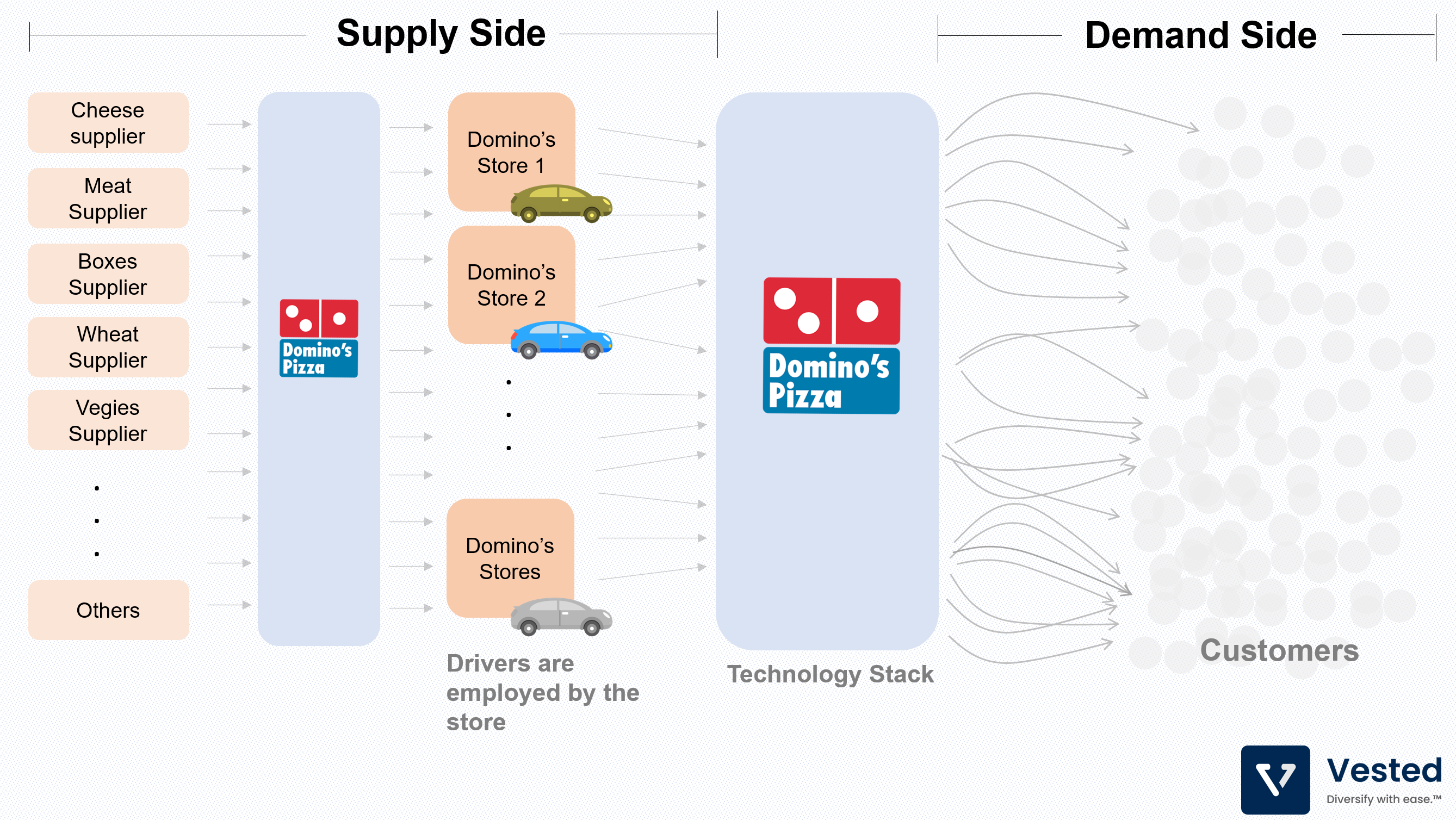

In order to understand Domino’s business, it is necessary to understand its value chain (Figure 3).

From left to right:

- Suppliers of pizza ingredients sell their products to Domino’s who operate its own dough manufacturing and distribution centers. By leveraging its size, Domino’s can negotiate lower supply costs, which it sells to the franchised stores. By having control of the manufacture and distribution of supplies, the company can ensure quality and consistency of supply.

- Domino’s stores are either owned by the company or by franchisees. These stores produce the pizzas. Similar to McDonald’s, the vast majority of stores (~98%) are owned by others.

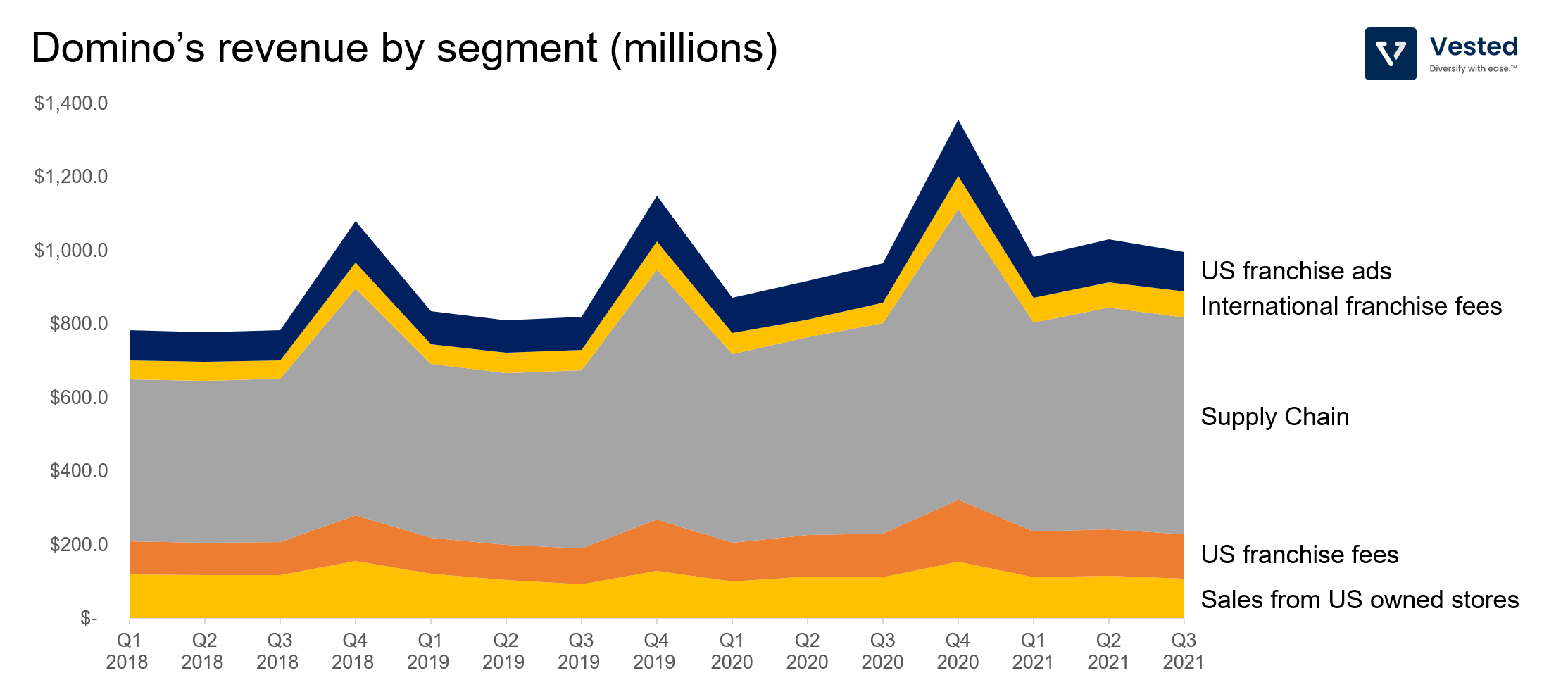

- Supply chain revenue is the highest revenue source (grey), or about 59% of total revenue. But it is also the segment with the lowest operating margins (at about 11%).

- Sales from US owned stores generate about 11% of revenue (as of Q3 2021), with about 20% operating margin.

- Franchise fees (Domino’s charges its franchisee 5.5% of gross sales + technology fees), from both US and international markets, contribute to ~19% of revenue, which is almost pure operating profit.

- Ad revenue is run as a non-profit entity, with zero contribution towards operating margins.

By leveraging the low-margin supply chain business, Domino’s generates really high-margin franchise royalty fees. As a result, Domino’s blended operating margin is ~18% as of September 2021 (much higher than the typical 3 – 5% for a typical restaurant business).